We’re wrapping up the first week of September with a focused set of launches and improvements on ApeX Omni. Two new listings went live (XPL and Linea, both with 50× leverage), the ApeX Official Vault recorded a 24-hour APY peak of 47.9% on 02/09, and we prepared several system updates that enhance alerts, execution clarity, and wallet choice.

1. Prediction Markets Challenge Wrapped Up

The Prediction Markets Challenge has officially concluded. Trading rewards have been distributed, while feedback-based rewards remain under review where applicable. Thank you to everyone who participated and helped spotlight Prediction Markets across the ecosystem. Missed this round? Stay tuned for future challenges.

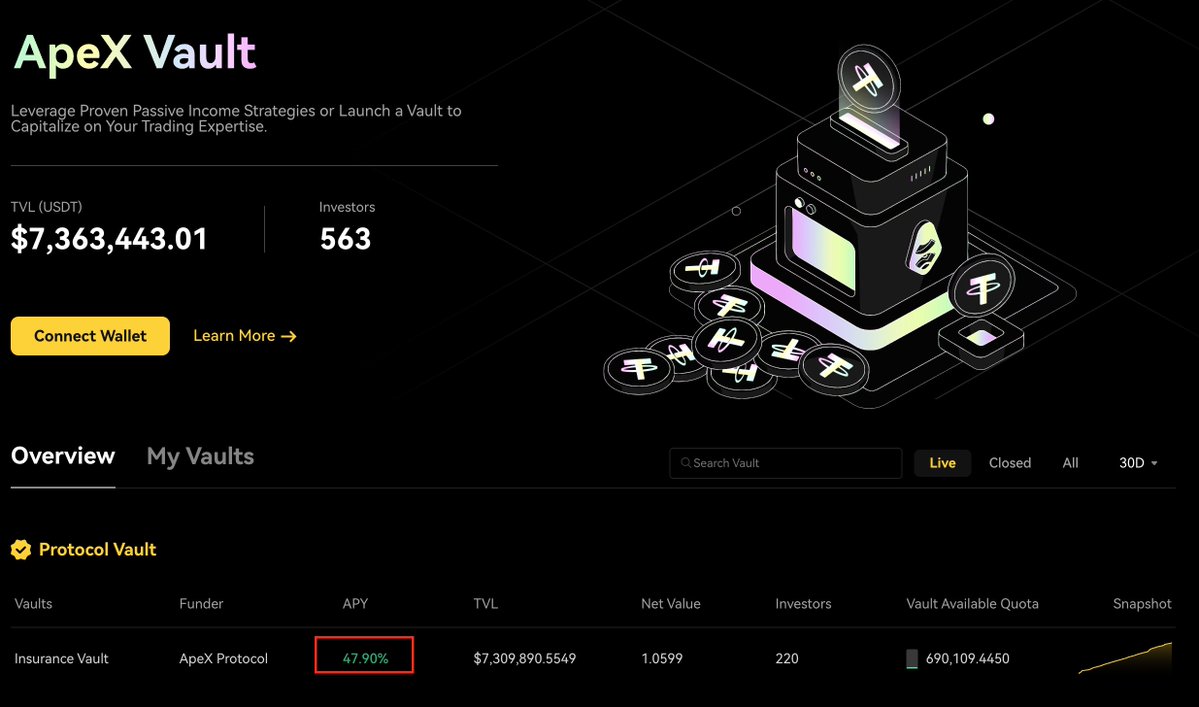

2. Vaults Update: 24h APY Peak

The ApeX Official Vault recorded a 24-hour APY peak of 47.9% on 02/09. This is a short-term snapshot; returns vary with market conditions and are not guaranteed. Why it’s useful: Transparent performance snapshots help users monitor variability before assessing longer-term trends.

3. Two New Listings: XPL & Linea (50× leverage)

Perpetual contracts for XPL and Linea are now available with up to 50× leverage. These pairs expand instrument choice for directional views and hedging, under the same margin, funding, and liquidation framework as existing markets.

Risk reminder: Leverage amplifies gains and losses; size positions and set alerts accordingly.

System Updates

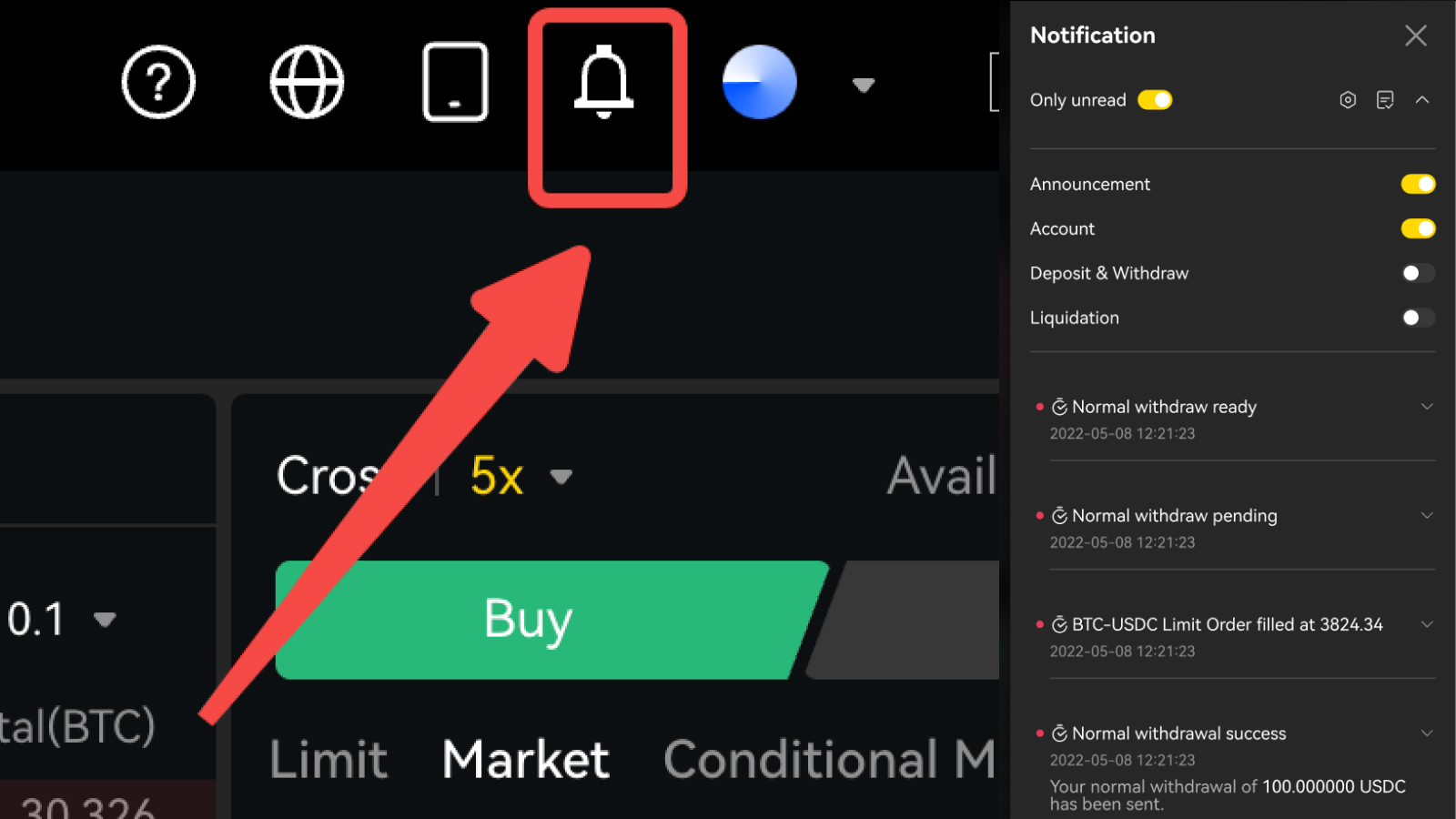

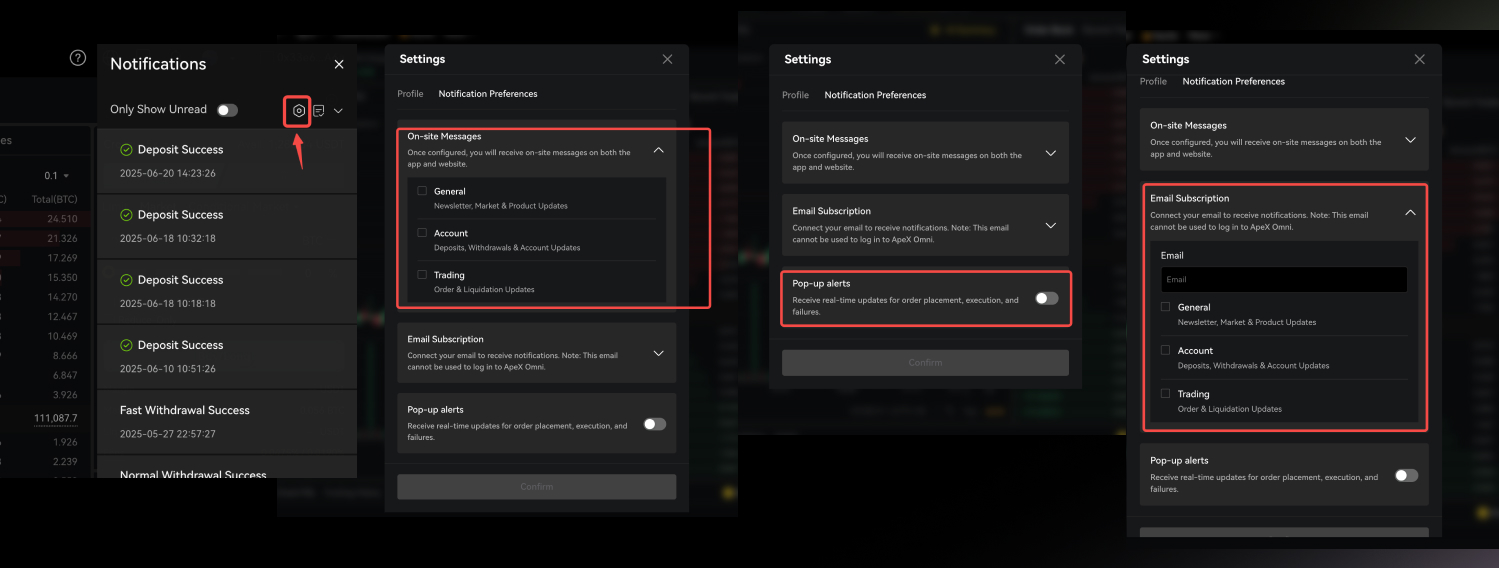

1. Notification Alerts

Notification Alerts are now live on Web (since Sep 3, 10:00 UTC) and will be available on App v3.28.0 once review completes (expected by Sep 5). This rollout brings a more complete alert framework across both platforms:

Liquidation Risk Alerts: Push, inbox, and email warnings when margin ratio reaches 80%, with a follow-up alert if it rises to 90% within an hour.

Web Enhancements: Refined pop-up design and expanded settings to manage inbox messages, email subscriptions, and order pop-up reminders. Supported notifications include deposit confirmations, standard and instant withdrawals, ADL notices, liquidation events, and both perpetual and spot order executions.

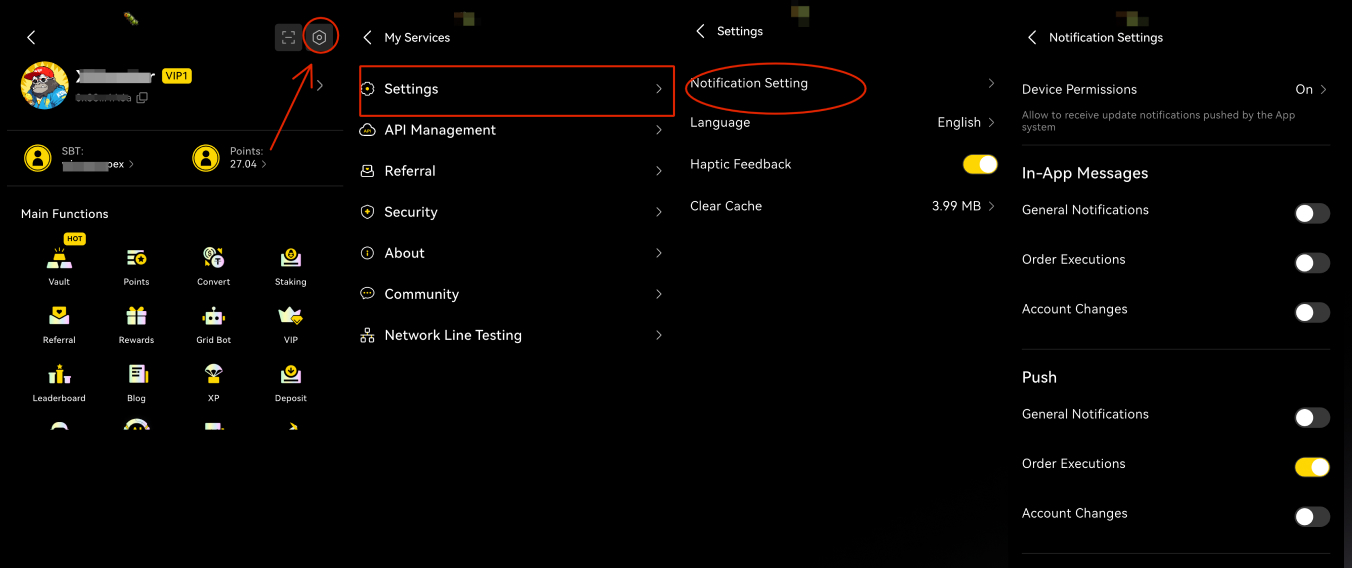

App Enhancements: Updated notification layout with additional settings, allowing users to customize inbox message delivery and order pop-up reminders.

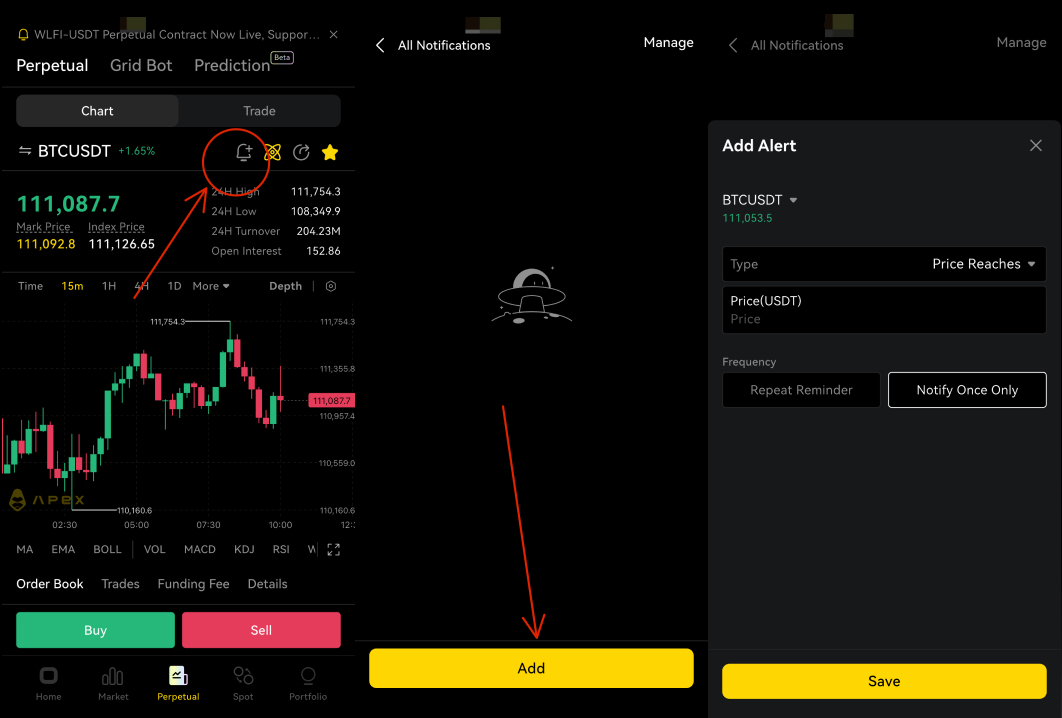

Contract Price Alerts (App): Triggers when a user-set price or 24h price change threshold is reached.

Favorite Pair Alerts (App): Proactive daily push (once per 24h) for significant moves in starred pairs, toggleable in Settings.

2. Trading Optimization 3.0 (ships with App v3.28.0)

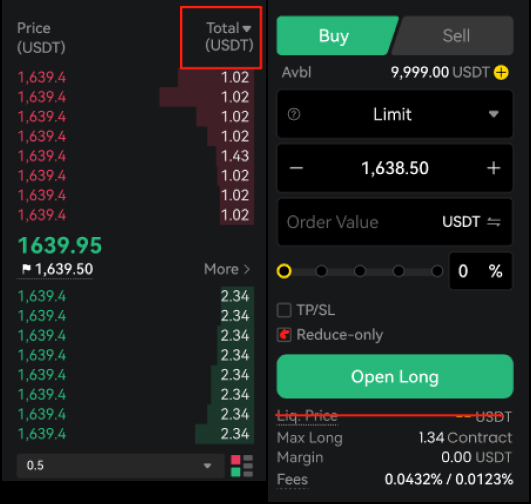

This update adds an orderbook total column in USDT (with synchronized Amount units), hides Liquidation Price in Reduce-Only mode, and refines PnL/return-rate formulas for both limit-close and market-close flows. Rollout is bundled with App v3.28.0.

Why it matters: Clearer tape reading, lower cognitive load at entry/exit, and more consistent performance metrics.

Orderbook Totals in USDT: A new total column in USDT has been added, with the Amount field automatically switching units when the Total unit is changed. This makes it easier to view cumulative values in a standard currency.

Reduce-Only Mode Simplification: The Liquidation Price field is now hidden when Reduce-Only mode is selected, reducing clutter when placing limit, market, conditional, or TWAP orders.

Updated PnL Formula for Limit-Close Orders: Profit for longs is calculated as Order Size × (Trigger Price – Entry Price), while shorts are Order Size × (Entry Price – Trigger Price). Return rate is expressed as Profit ÷ (Entry Price × Order Size × Initial Margin Rate) × 100%.

Refined PnL Formula for Market-Close Orders: Profit for longs is measured as Order Size × (Best Ask Price – Entry Price), and for shorts as Order Size × (Entry Price – Best Bid Price), applying the same return-rate formula as above.

3. Binance Wallet Now on Web

Binance Wallet has been added to the Web wallet list (already supported on App), bringing parity across platforms and offering a familiar option for onboarding. Why it matters: Expanded wallet choice reduces setup friction and supports user preference.

4. Daily Earnings Display (Vault) — Sep 5, 09:00 UTC

A Daily Earnings Display will go live for the Vault interface on Sep 5 at 09:00 UTC, providing a day-by-day view of results. Why it matters: Granular reporting improves transparency and helps users track performance over shorter windows.

At ApeX, community feedback guides what we build—from alerts and optimization to listings and vault visibility. Keep sharing what helps you trade more effectively, and we’ll keep translating that into pragmatic releases on Web and App.