Perpetual futures offer leverage and flexibility—but the biggest risk is liquidation: a forced close when your equity (collateral ± unrealized PnL − fees/funding) cannot cover the maintenance margin on open positions. This guide balances substance and readability to help spot-proficient traders set robust buffers, choose appropriate collateral, and manage margin professionally. If your goal is to avoid liquidation crypto incidents, the most reliable edge is applying disciplined margin tips to perpetual trading before you place an order.

How Liquidation Is Triggered

Maintenance margin is the minimum capital required to keep a position open. Your account equity rises and falls with PnL, fees, and funding. When equity falls to the maintenance requirement, the liquidation engine takes control. Liquidations reference a mark price (a fair-value benchmark) rather than the last traded price to mitigate thin-liquidity manipulation—although in fast markets, slippage can still result in worse-than-expected exits.

Most venues expose a margin ratio. At 100% the account (or position) is liquidated. Many practitioners treat ~80% as an internal threshold to add collateral, reduce exposure, or close.

Cross Margin vs. Isolated Margin — Practitioner’s Playbook

Isolated Margin: The Ring-Fenced Model

Isolated margin assigns a dedicated collateral bucket to a single position. Losses are confined to that bucket unless you add margin.

Benefits:

Losses are contained to one position

Clear maximum loss per position (absent further top-ups)

Straightforward to stabilize a position by adding margin to that leg only

Trade-offs:

Lower capital efficiency than cross margin

Requires per-position monitoring and timely top-ups

A position can liquidate even if spare funds exist elsewhere in the account

Best for:

Higher-volatility positions, newly listed markets, and scenarios requiring strict per-position risk limits

Cross (Portfolio) Margin: The Shared-Equity Model

Cross margin pools equity across all positions. A losing position can draw on profitable positions or idle funds to avoid immediate liquidation—until the shared pool is depleted.

Benefits:

More resilient to modest adverse moves

Profitable positions can offset drawdowns elsewhere

Efficient for hedged or multi-leg portfolios

Trade-offs:

Contagion risk: one deteriorating position can endanger others

Harder to pre-define a firm maximum loss

Requires vigilant monitoring of account-level margin ratio

Best for:

Hedged or paired strategies and correlated baskets under active management

Maintenance Margin & the “Hidden Drags” on Equity

Funding (periodic carry). If you are on the paying side, funding is deducted at fixed intervals and directly reduces equity. Treat it as an overnight carrying cost: it does not move price, but it moves your margin ratio. Before holding through multiple intervals, estimate the total drag (notional × funding rate × number of intervals). If projected funding consumption exceeds ~10–20% of your buffer, reduce size, add collateral, or shorten the holding period.

Trading costs (fees + price impact). Round-trip taker fees and slippage are small per transaction but material near liquidation. A modest taker fee on both entry and exit plus 10–50 bps of slippage in fast markets can remove a meaningful portion of your buffer. These costs raise break-even and narrow the cushion. Prefer limit (maker) entries at predefined price levels, split order size to reduce impact, and include an all-in cost line (fees + realistic slippage) in every pre-trade calculation.

Gaps & slippage around the mark. Liquidations trigger on mark price. In fast conditions, the mark can gap through your threshold and the forced exit will fill where liquidity exists, which may be worse than your estimated liquidation price. Treat that estimate as guidance rather than a guarantee, and keep your liquidation level outside the asset’s typical short-term volatility band.

Collateral Strategy: Stable vs. Coin (Predictability vs. Convexity)

Stable-margined (USDT/USDC) contracts keep collateral value steady in USD terms. Risk calculations remain predictable and maintenance targets are easier to manage. For most directional trading, this clarity is advantageous.

Coin-margined (inverse) contracts denominate collateral and PnL in the underlying asset. This introduces convexity: for long positions during declines, you lose on the position and the collateral’s USD value falls—pushing you toward liquidation faster. The reverse can provide a tailwind in persistent uptrends. Use coin margin intentionally (e.g., inventory hedges or asset accumulation) with predefined rules.

Bottom line: prefer stable collateral for day-to-day clarity; use coin margin for specific, well-defined strategies.

Pro Habits That Prevent Liquidation

Size the buffer deliberately, not by intuition. Target at least 30% free margin beyond requirements, or—if larger—2× projected funding, 2× fees + slippage, and 0.5× your timeframe’s expected volatility band (e.g., 0.5 × 1-hour ATR as a % of price × notional). If the live buffer falls below this target, reduce exposure or add margin immediately.

Let volatility set leverage. Reserve higher leverage for low-volatility periods and shorter holding times; otherwise, keep leverage modest. As a practical guardrail, consider up to ~5× on majors in calm conditions, ~3× in typical sessions, and ~2× (or stand aside) for high-volatility alts or event-risk days. If a plan requires extreme leverage to be viable, reassess entry, stop placement, or timing.

Place stops well ahead of maintenance and anchor them to structure. Stops should sit beyond market noise—typically past the nearest invalidation level and buffered by ~1.2–1.5× ATR of your trading timeframe. If that placement conflicts with your risk budget, tighten entry, reduce notional, or defer the trade. The liquidation engine is not an exit strategy.

Always size from the stop, not from desired PnL. Convert your risk budget (e.g., 1% of account equity) and your stop distance into maximum notional: Position Notional = (Account Equity × Risk %) ÷ Stop Distance %. After sizing notional, determine the margin you will post to set leverage, rather than forcing leverage first.

Treat funding windows as decision points. If you will be paying funding and the projected cost across upcoming intervals consumes your buffer, adjust before the window. For longer holds, consider trimming, partial hedges, or adding margin so carry does not quietly push the margin ratio toward risk thresholds.

Match margin mode and collateral to the strategy—and commit to the rules. Use isolated + stable collateral as a default for single, higher-volatility positions requiring ring-fenced risk. Use cross margin only when positions hedge or diversify one another and you actively monitor the account-level ratio in real time. If you choose coin-margined exposure, do so for a defined purpose and pre-set add-margin limits.

Illustrative Scenarios

1) 5× long, stable collateral — drawdown + carry

Setup: $10,000 notional at 5× with $2,000 margin; assume maintenance ≈ $80.

Move: A 6% adverse move (−$600) leaves $1,400 equity.

Carry impact: A small taker round-trip and one funding interval (≈ $13) trims equity to ~$1,387.

Implication: Still above maintenance, but the buffer has narrowed; reduce size or add margin before the next leg rather than approaching the liquidation threshold.

2) Cross-margin contagion — shared pool, shared fate

Setup: Two longs on cross: $50k BTC and $10k SOL with $20k account equity.

Shock: BTC −10% (−$5k) pulls equity to $15k; a modest SOL dip tightens both margin ratios because the shared pool funds survival.

Implication: A further BTC decline plus correlated SOL softness can push the account to maintenance, triggering partial then full liquidation. Cross margin can provide short-term resilience but does not prevent portfolio-level risk; monitor aggregate losses and de-risk early.

3) Slippage & fees — beyond the estimated liquidation price

Setup: The estimated liquidation price for a short is near $100.

Event: A fast move gaps the mark to $102.

Implication: The forced exit fills around $102 + fees, worse than the estimate. Treat the estimate as guidance, maintain additional cushion, and avoid operating at the threshold.

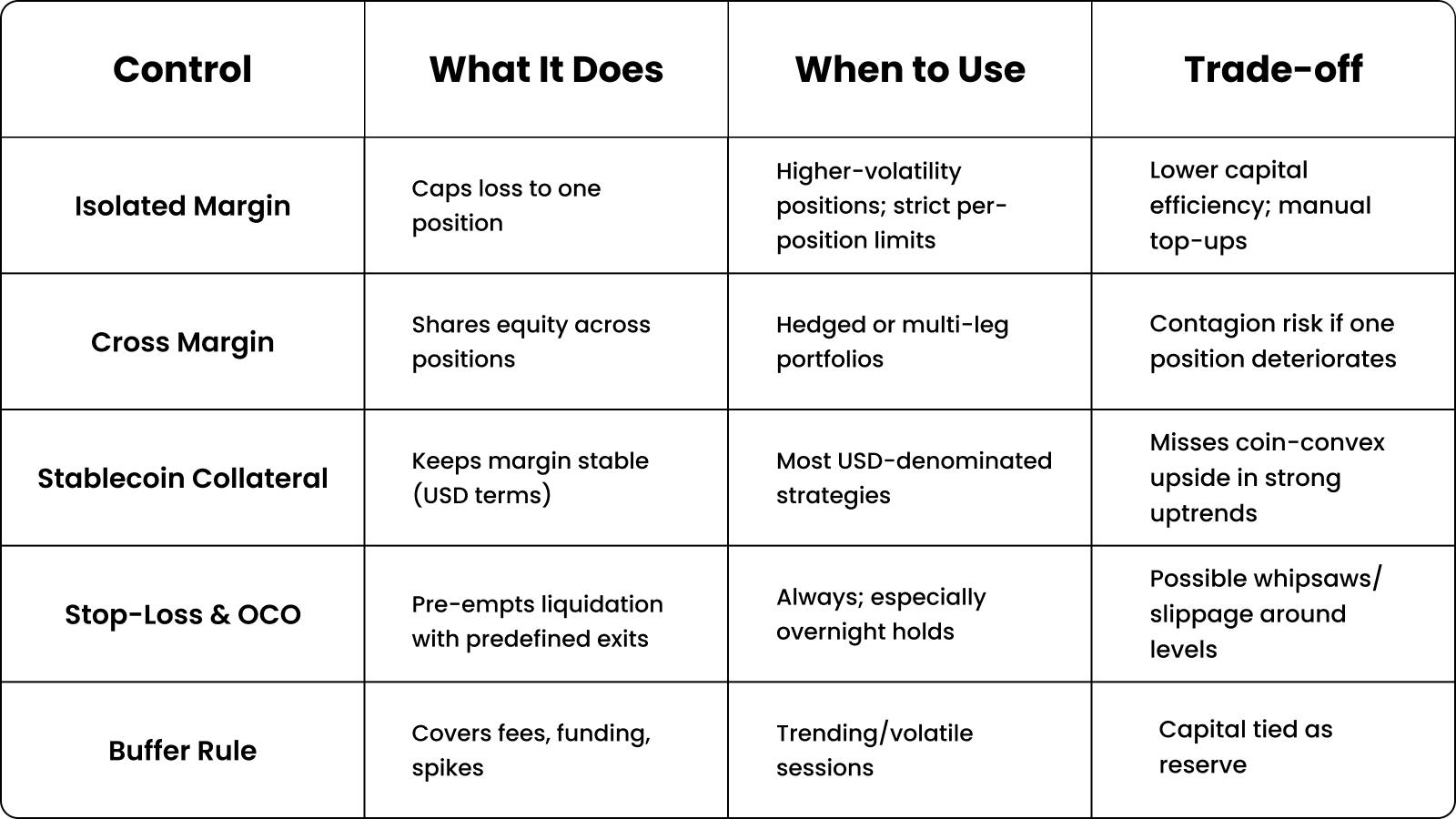

Quick Controls

Pre-Trade & In-Trade Checklists

Pre-Trade

Confirm margin mode (isolated for tactical positions; cross for hedged portfolios).

Choose collateral (stable for clarity; coin only with a defined objective).

Set your stop first, then size from risk %.

Review funding and intended holding period; include the all-in cost in your plan.

In-Trade

Monitor margin ratio and set alerts around 80–85%.

Add or reduce margin early; do not wait near the threshold.

Re-check funding ahead of each window and avoid paying elevated rates across multiple intervals.

Conclusion: A Repeatable Operating Cadence

Successful perpetual-futures trading is less about maximizing leverage and more about executing a consistent process. Define buffers that reflect carry and transaction costs, let realized volatility set leverage, and place stops at structural invalidation levels well ahead of maintenance. Size every position from the stop so risk per position stays consistent, and treat funding windows as scheduled decision points. When margin mode and collateral match the strategy—and you adjust early as buffers thin—you keep leverage working for you, protect solvency through turbulent periods, and remain positioned to capture the next opportunity.

Kick Off Trading on ApeX Omni

ApeX Omni puts the world of decentralized trading at your fingertips — from crypto perpetuals and spot markets to U.S. stocks, prediction markets, and beyond. With deep liquidity, advanced tools, and gas-free execution, it’s never been easier to start trading on a DEX and craft strategies that match your goals.

Learn & Earn: $100 USDT Per Quest!

Turn your crypto knowledge into real rewards with our Learn & Earn series. Complete quick quizzes on Galxe and earn $100 USDT for each quest you finish.

Make sure your wallet is linked to ApeX Omni, then jump in and start claiming your rewards — it's fast, easy, and rewarding!