Introduction to ApeX Prediction Markets

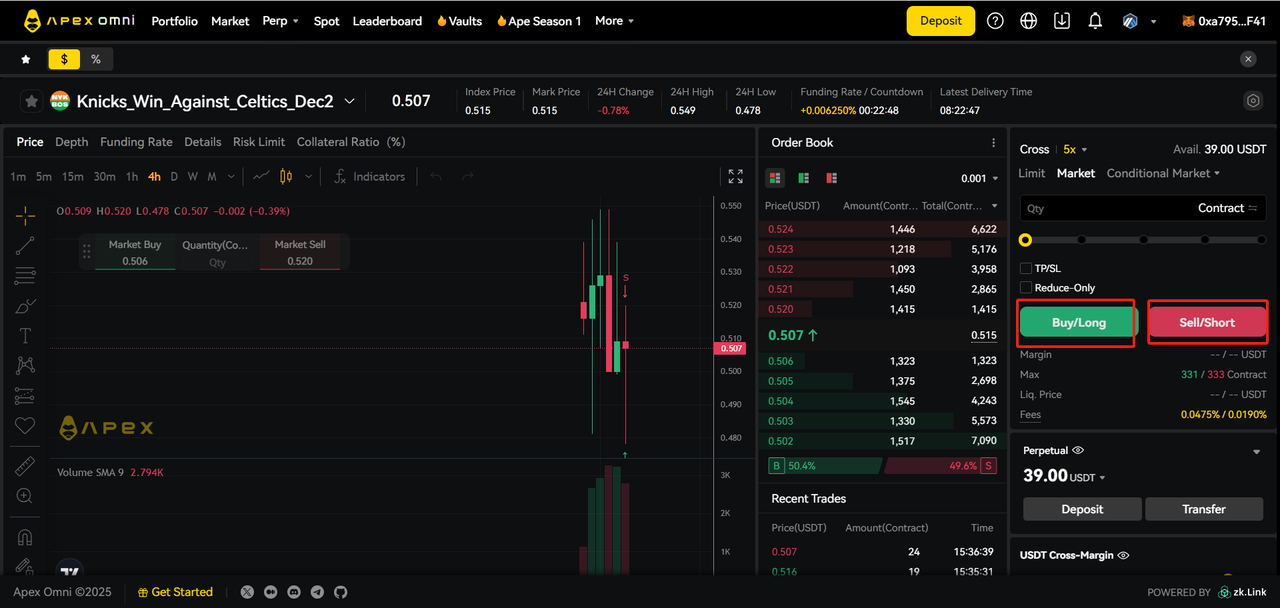

ApeX Protocol has expanded beyond traditional perpetual trading to offer prediction markets, where traders can speculate on real-world event outcomes with leverage. Unlike price-based perpetuals, prediction markets let you trade on whether specific events will happen or not, with prices representing the probability of outcomes.

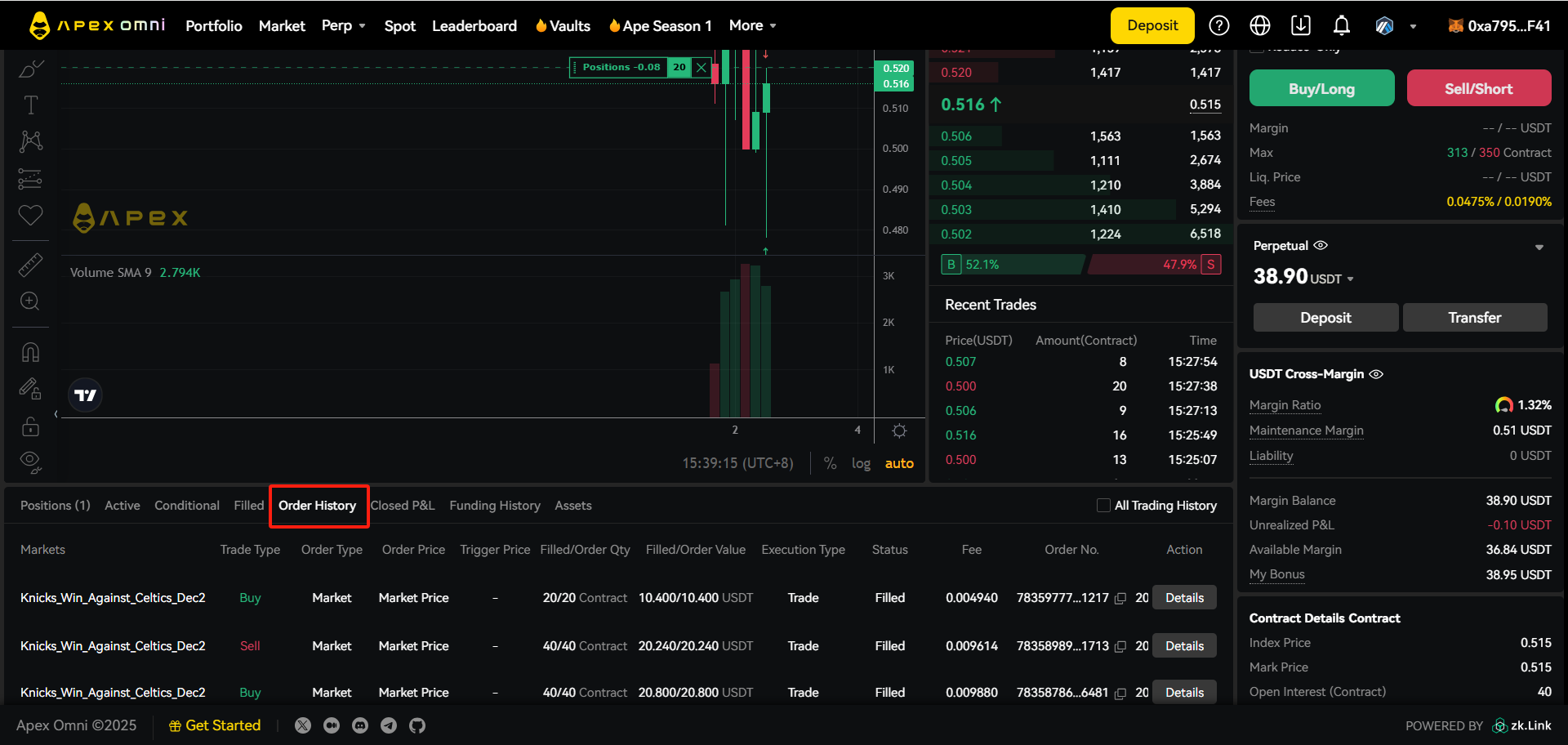

We've recently launched NBA prediction contracts, allowing you to trade on game outcomes like "Knicks Win Against Celtics" or "Lakers Beat Warriors" with up to 20x leverage. Each event trades between 0.001 and 0.999, representing the market's view of the probability, and settles at either extreme based on the actual outcome.

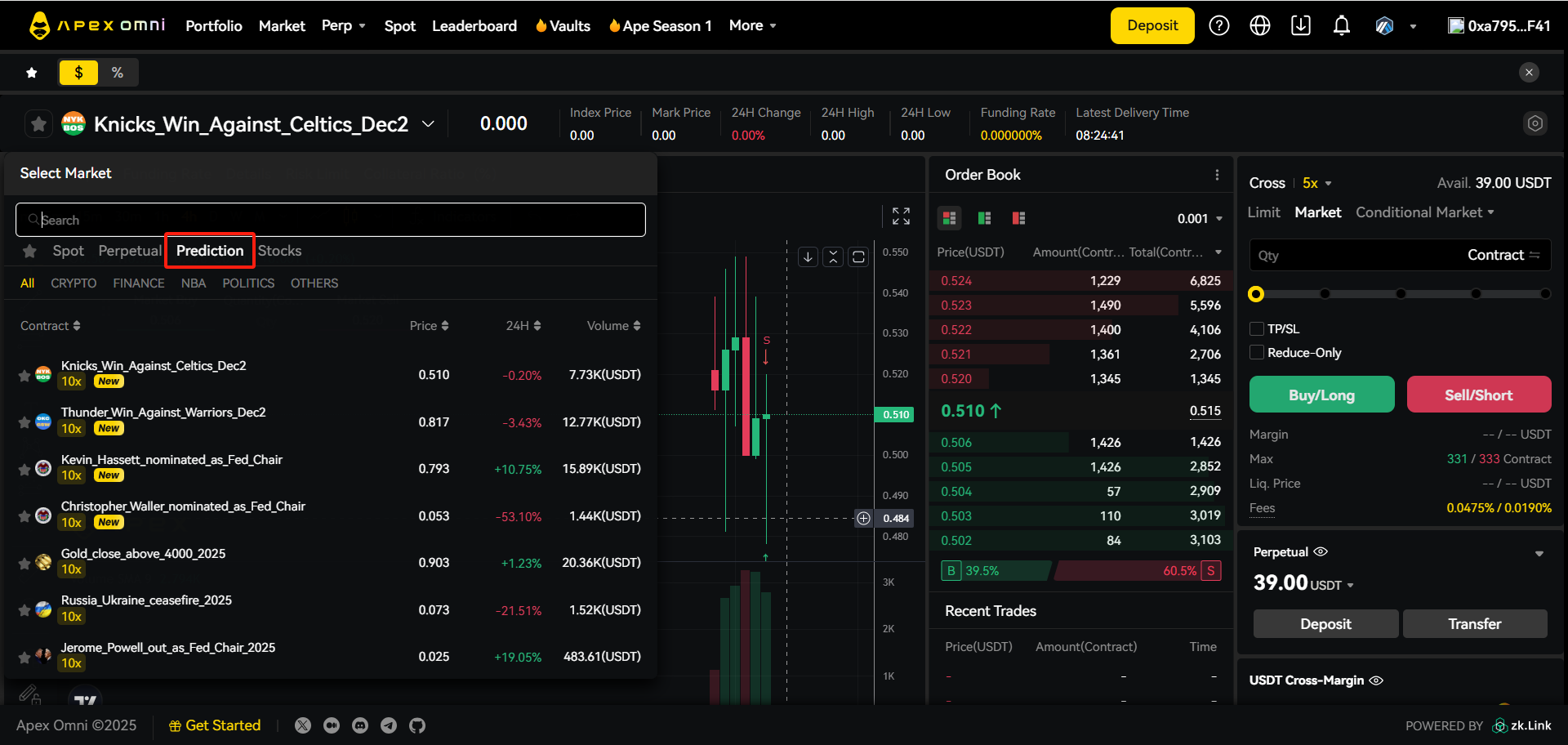

Finding Your First Prediction Market

Start by navigating to the Prediction section where you'll see all available events to trade.

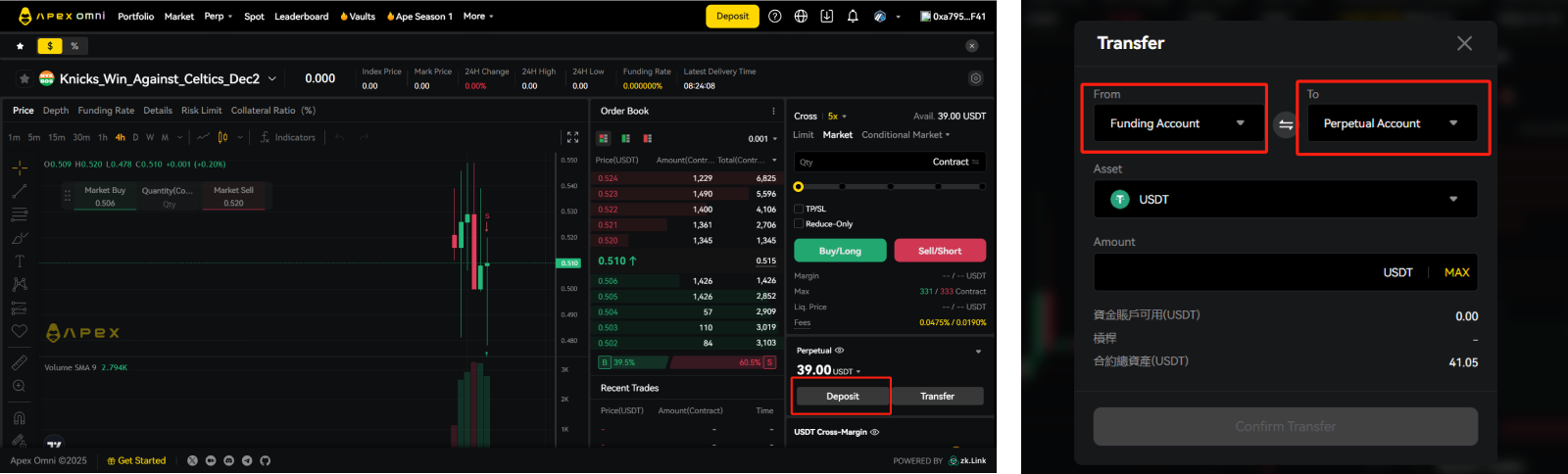

Setting Up Your Funds

Before placing your first prediction trade, you'll need to convert funds from your Cash or Stock account into your Perpetual account. This separation helps manage margin requirements across different trading types.

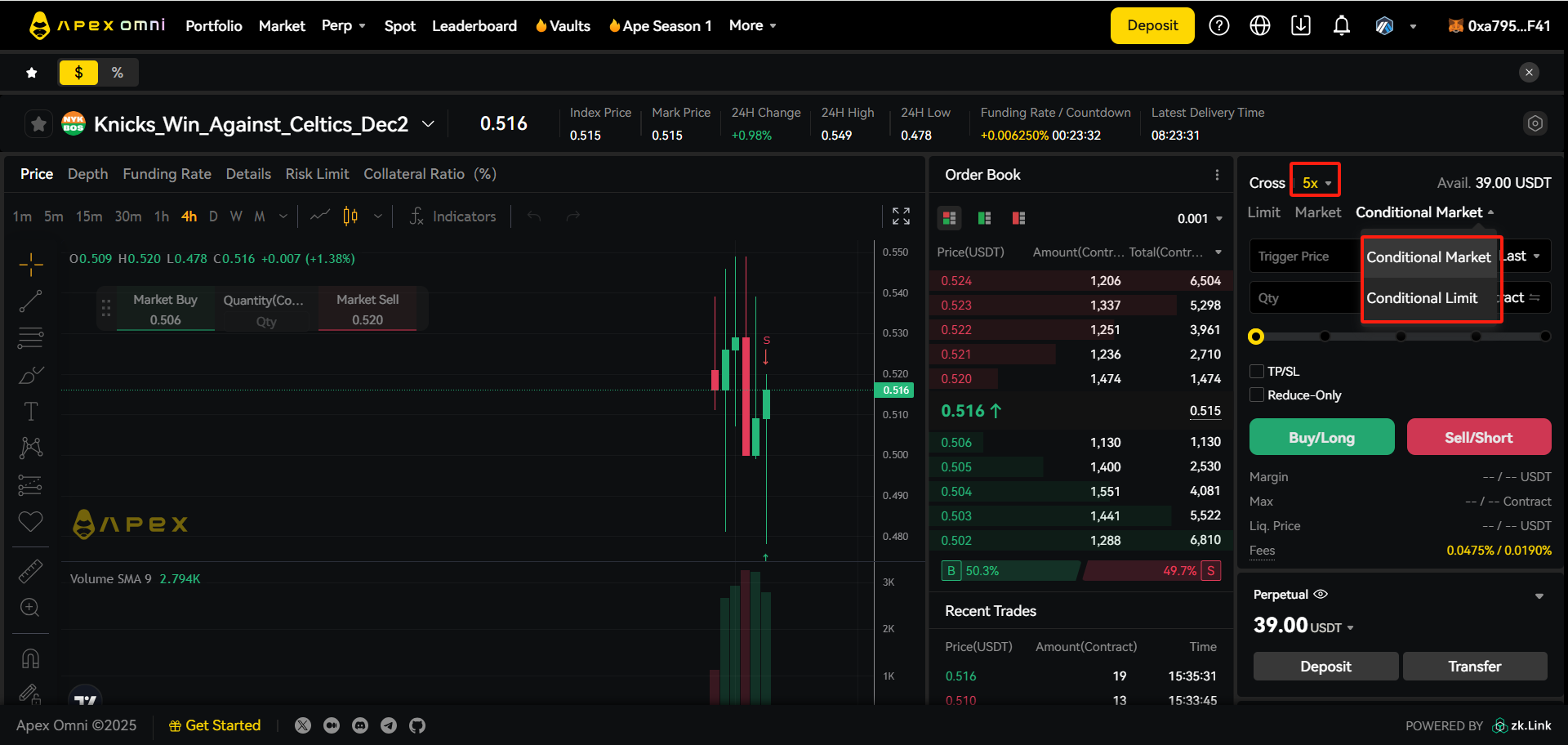

Choosing Your Leverage

Prediction markets offer flexible leverage options ranging from 2x to 20x, adjusted based on each event's risk level.

Market Order/Limit Order: Refers to executing a buy or sell at the set quantity and direction when the trigger condition is met, either at market price or a specified limit price. This means you can choose between market orders for immediate execution or limit orders to trade at specific price levels.

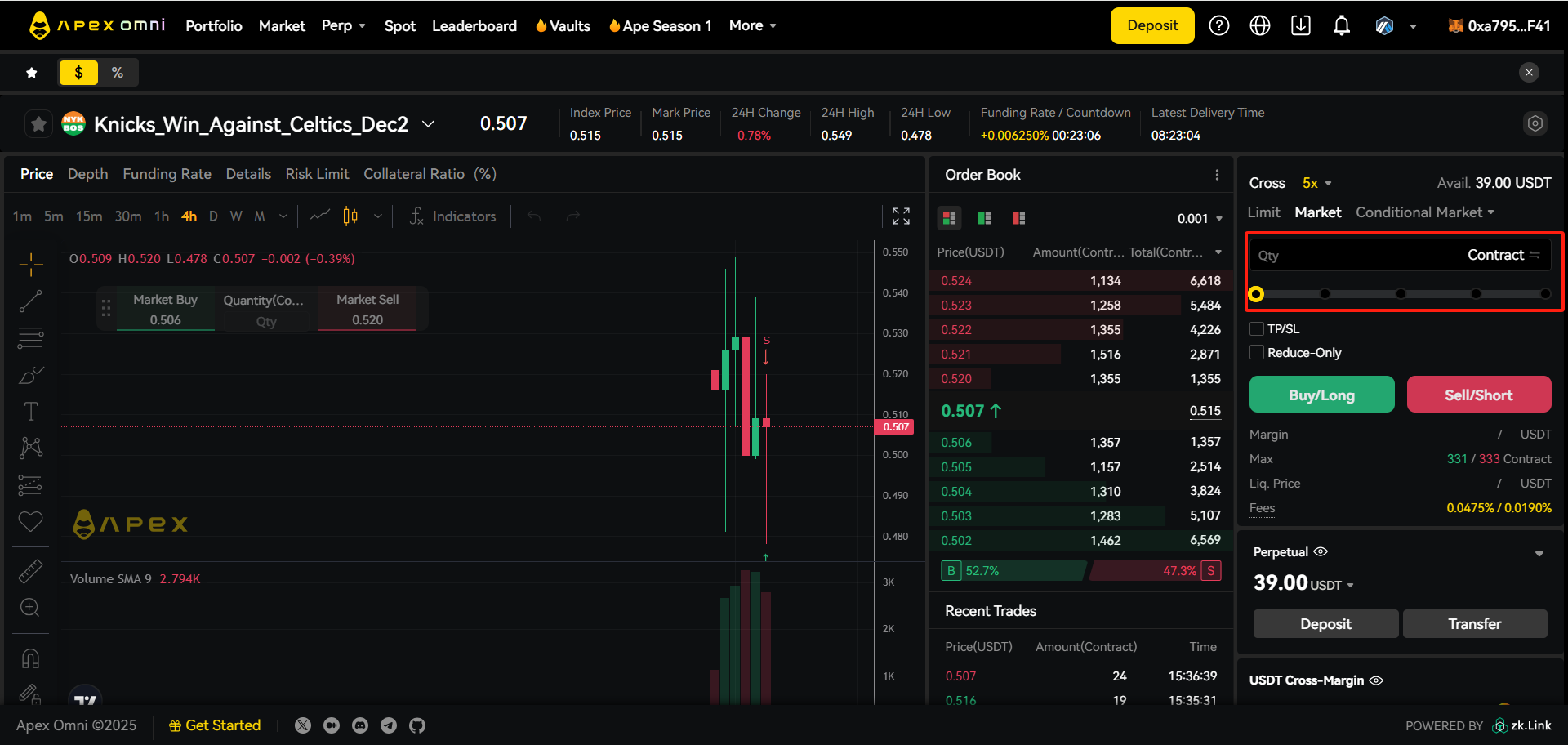

Understanding Opening Costs

When opening a position, you can denominate your trade in either Contracts or USDT (stablecoin). This choice determines your opening quantity and position value.

The Trading Mechanics

Trading prediction markets follows simple logic:

Long = Betting the event will happen

Short = Betting the event will not happen

Price increase/decrease = Probability increase/decrease

At final settlement, events resolve to either 0.999 (event happened) or 0.001 (event didn't happen), creating a winner-takes-all outcome.

Trading Guidance

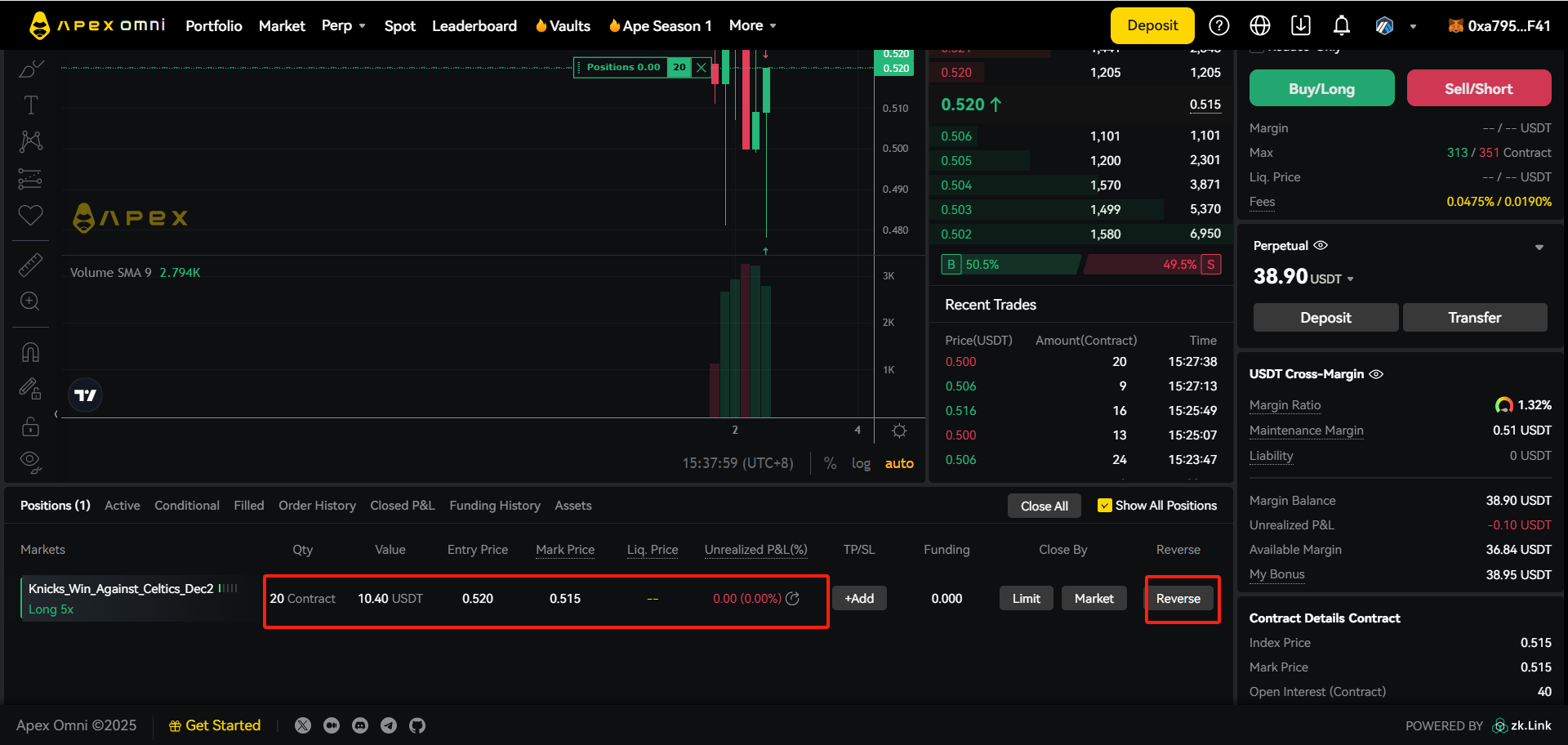

Let's walk through an example. If you believe an event will occur and choose 5x leverage with 20 USDT, you're controlling a position worth 100 USDT (20 × 5). If you think the event won't happen, you'd sell or go short instead.

Managing Open Positions

Once your position is open, you'll see real-time updates on your profit and loss. The platform offers a "Reverse" feature that lets you close your current position and immediately open one in the opposite direction with a single click.

Setting Risk Parameters

Protect your trades with automated risk management tools:

Take Profit locks in gains when your target is reached. For instance, if you buy at 0.1 and set take profit at 0.12, the position automatically closes for a 20% gain when that price hits.

Stop Loss limits potential losses. Setting a stop at 0.08 when you bought at 0.1 means accepting a maximum 20% loss if the trade moves against you.

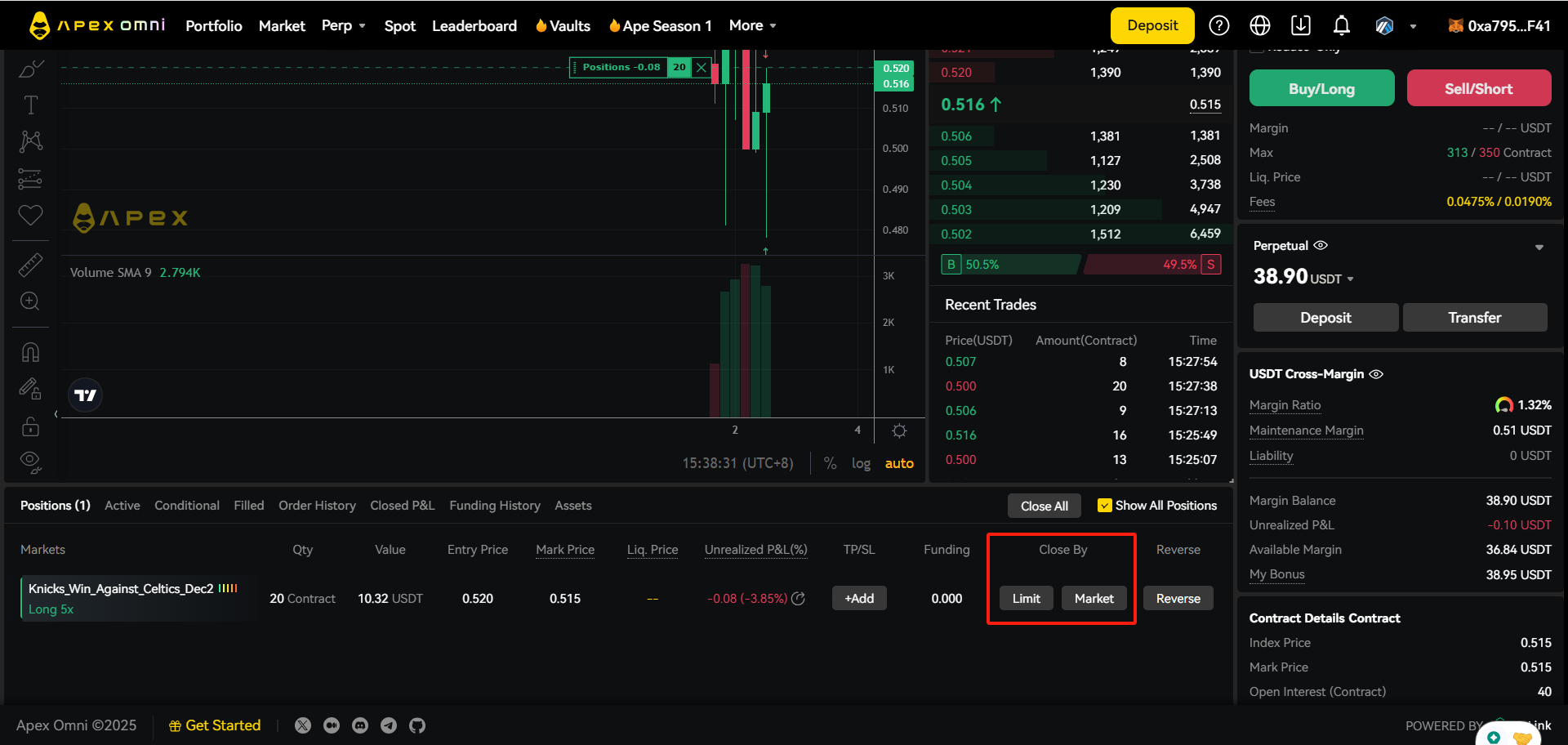

Closing Your Position

When you're ready to exit, you have two options:

Market orders close immediately at the current price

Limit orders wait for your specified price before executing.

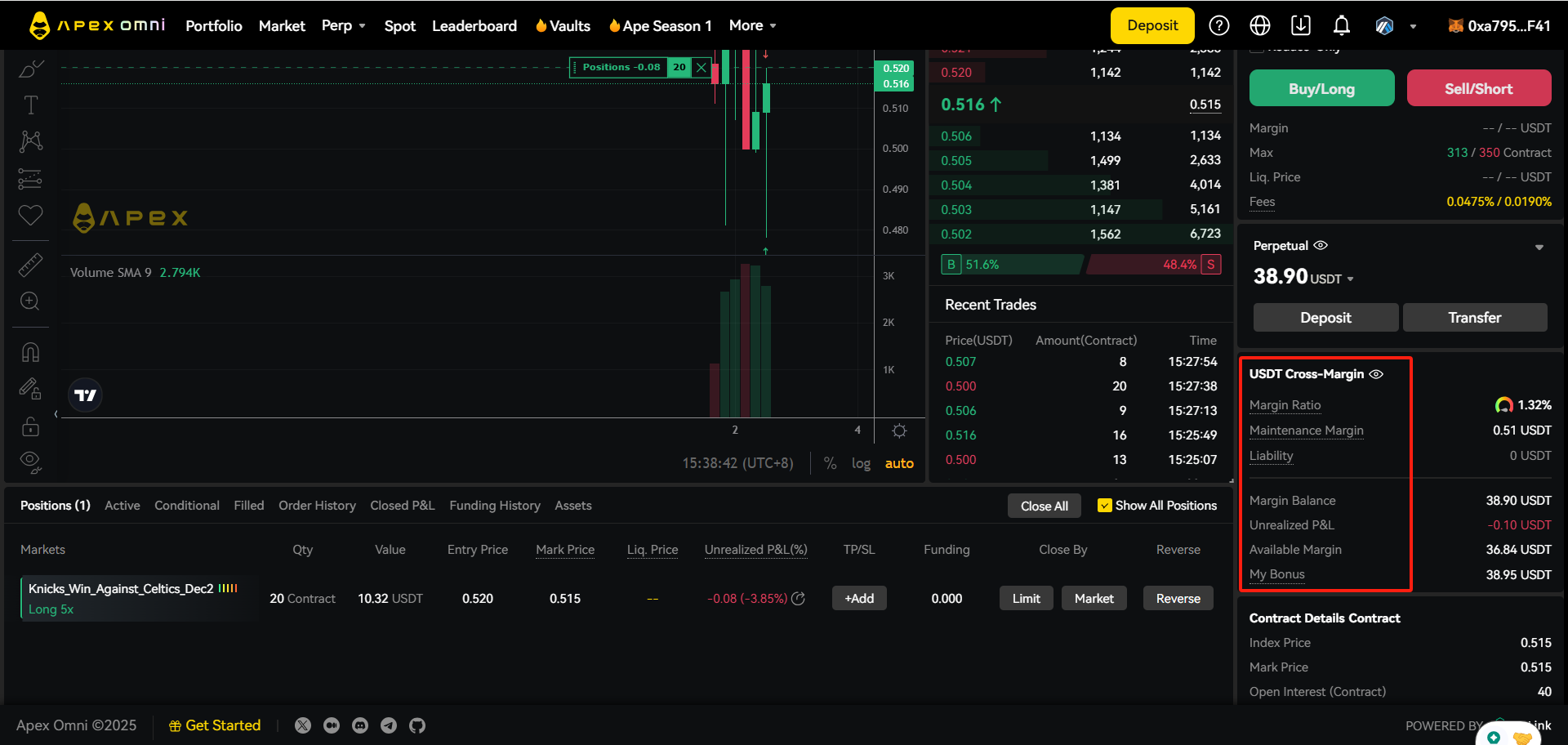

Understanding Margin Requirements

Your margin equals your position value divided by leverage. As position sizes change, so do margin requirements, with actual amounts displayed in real-time on the platform.

The system shows your maximum position capacity and estimated liquidation price. Remember, this liquidation estimate is for reference only, as the actual level depends on your average entry price, floating profit/loss, and available margin.

Reviewing Your Trading History

Track your performance by accessing the "Historical Orders" section, where you can review all past trades and their profit/loss outcomes.

Disclaimer

Cryptocurrency investments are subject to high market risk and volatility. Please conduct your own research and invest cautiously.

Website: https://www.apex.exchange

Twitter: https://twitter.com/OfficialApeXdex

Telegram: https://t.me/ApeXdex

Discord: https://apex.exchange/discord