The recent volatility in the crypto market has brought a long-standing debate to the forefront of the industry. When Bitcoin swings $30,000 in less than a month, the pressure on human psychology becomes immense. This reality formed the core of a recent ApeX Protocol AMA where experts Ah Chao, Freya from Solulu, and quantitative trader Tinker explored whether traders should finally cede control to artificial intelligence.

The Biological Disadvantage: Why Humans Falter

Contract trading is as much a battle of psychology as it is a battle of charts. The panel highlighted that the primary edge AI holds is not just its processing power but its total lack of emotion. Humans are biologically wired for emotional leverage, which often manifests as an irrational urge to double down on losing positions to "win back" capital.

AI acts as a cold execution machine that removes the dopamine hits and the physical pain of cutting a loss. While a human trader might hesitate during a sharp $30,000 drop, an AI follows its mathematical logic without a pulse. By removing the emotional urge to go all in blindly, AI essentially functions as a built in de-leveraging tool for the modern portfolio.

The Speed War: The Millisecond Frontier

In traditional and crypto finance, the statistic that 90% of retail investors lose 90% of their principal within 90 days remains a harsh reality. AI attempts to break this cycle through sheer frequency and calculation volume.

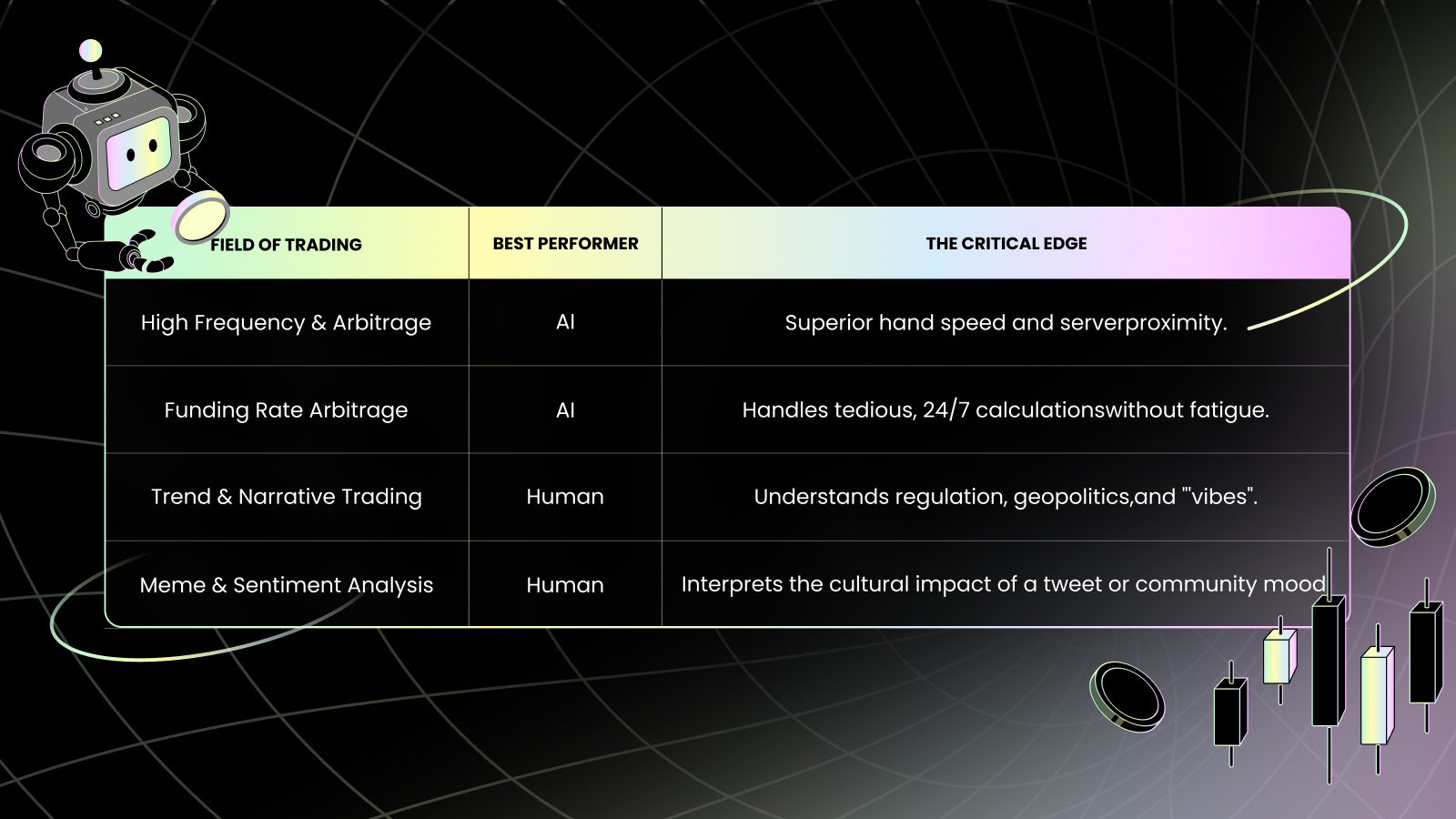

Trading is fundamentally a probability game. Tinker explained that AI works like a weaving machine, casting a dense net across the market to find slight edges in win rates. This is most evident in high frequency arbitrage where the war is won in milliseconds. Because an AI can place hundreds of orders in the time it takes a human to blink, certain niches like quantitative arbitrage and market making have become the exclusive domain of automated programs.

The Human Advantage: Context, Culture, and Imagination

Despite the mechanical superiority of bots, they remain confined by historical data. The panel agreed that while AI is the perfect executioner, it is a poor architect for new frontiers.

Humans still dominate the "Now" and the "New". An AI might struggle to understand why a specific meme coin is pumping based on cultural sentiment or a cryptic tweet. Humans possess the unique ability to connect complex narratives, imagine future possibilities beyond history, and react to shifting geopolitical landscapes.

Strategic Coexistence: Putting the Bot to Work

The future of trading is not about humans versus machines, but rather humans using machines as productivity multipliers. The experts suggested several ways to integrate AI without losing the "human touch" that provides the creative alpha:

Automate the Boring: Use AI for structural operations like funding rate arbitrage where high annualized yields require constant, tedious monitoring.

Extreme Risk Management: Program AI to handle "Rolling Positions" or compounding leverage during extreme trends so you can sleep through black swan events without missing the window.

Improve Your Cognition: Recognize that as more people use AI, the winner is the one with the better strategy behind the bot.

Survival in the Dark Forest: A Security Warning

Handing API keys to a bot creates significant security risks. The panel emphasized that in the "Dark Forest" of crypto, whoever holds the key owns the money. You should never share your seed phrase or private keys with an AI. Instead, run APIs in isolated environments and treat "Black Box" bots with extreme skepticism.

Ultimately, AI replaces the executioner, but the human remains the architect. By leveraging machine discipline for the routine and human intuition for the narrative, traders can navigate the complex markets of 2026 with far greater precision.