The Evolution of DEX Architecture

Decentralized exchanges are no longer one-size-fits-all. As DeFi expands across multiple blockchains, two distinct architectural approaches have emerged to tackle the limitations of early DEX models. On one side, own-chain DEXs like Hyperliquid operate on dedicated blockchains built specifically for high-performance trading. On the other, multi-chain DEXs like ApeX Protocol leverage interoperability layers to aggregate liquidity from multiple networks into one unified platform.

Each model addresses critical pain points in trading—speed, cost, and liquidity—but comes with inherent trade-offs. This debate isn't just technical; it shapes the future of how traders interact with DeFi.

Why it matters: Understanding these architectural differences helps traders choose platforms that align with their priorities, whether that's lightning-fast execution or seamless cross-chain access.

Model 1: Own-Chain DEXs (Dedicated Blockchain Exchanges)

How it works: Own-chain DEXs operate on their own purpose-built blockchain where everything is optimized for trading performance. Hyperliquid, the category leader, launched a custom Layer-1 achieving sub-second finality with a fully on-chain order book. To trade, users must bridge assets from networks like Ethereum into this dedicated chain.

Key advantages:

Extreme performance: By controlling the entire stack, own-chain DEXs eliminate congestion from unrelated dApps. Hyperliquid processes 200,000 transactions per second with 0.2-second median latency—speeds that rival centralized exchanges

Zero trading fees: Gas costs can be completely eliminated since the chain is designed specifically for trading. Hyperliquid charges no gas fees, only trading fees

Professional-grade features: The dedicated infrastructure enables sophisticated order types, up to 50x leverage, and institutional-quality execution

Trade-offs to consider:

Isolated liquidity: Assets must be bridged to the custom chain, creating friction and siloing liquidity from the broader DeFi ecosystem

Centralization risks: Hyperliquid currently operates with only 16 validators, all selected by the core team

Novel security vulnerabilities: Custom infrastructure creates new attack vectors, as demonstrated by the March 2025 JellyJelly exploit that risked $230 million

Real-world performance: Hyperliquid dominates with 78.8% market share of DEX perpetuals, processing over $330 billion monthly volume. The platform's HLP vault manages $391+ million at 36% APR, democratizing market-making opportunities.

Model 2: Multi-Chain DEXs (Interoperability Layer Exchanges)

How it works: Multi-chain DEXs operate on interoperability layers that aggregate multiple blockchains. ApeX Protocol uses zkLink's Layer-3 rollup to lock assets from various chains into a unified pool, using zero-knowledge proofs to maintain consistency. Users can trade assets from different chains through one interface without manual bridging.

Key advantages:

Unified liquidity: A shared liquidity pool spans Ethereum, Solana, Base, and BNB Chain. Assets from different L2s appear as single tokens—no fragmentation

Truly gasless trading: ApeX Omni achieves zero gas fees for users by batching costs and subsidizing them at the protocol level

Ethereum-grade security: Zero-knowledge proofs anchor the system to Ethereum's security while achieving thousands of TPS

Trade-offs to consider:

Lower peak performance: ApeX processes ~3,000 TPS compared to Hyperliquid's 200,000 TPS

Added complexity: Users must understand and trust an additional layer between chains

Cross-chain risks: While mitigated through ZK proofs, multi-chain systems inherently have more potential failure points

Real-world adoption: ApeX Protocol has served 545,000+ users across multiple chains with a perfect security record—no major exploits or significant outages. The platform offers the only mobile-first derivatives trading app among major DEXs.

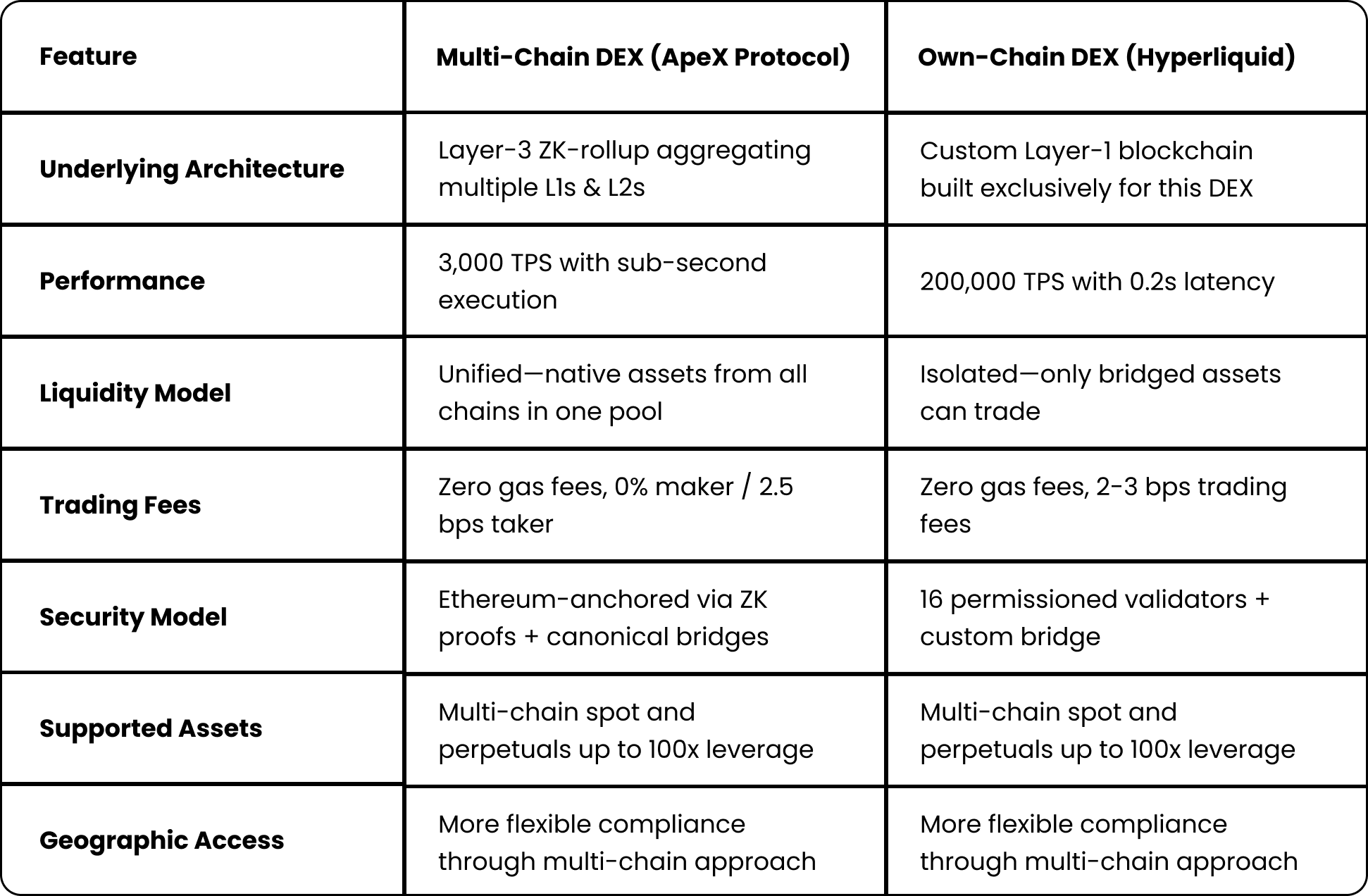

Comparison: Architecture Deep Dive

Let's examine how these approaches compare across key technical and operational dimensions:

Real-World Stress Testing: What Happens Under Pressure

High-Volume Scenarios

Hyperliquid's infrastructure shines during peak trading, regularly processing $10+ billion daily volume with minimal slippage. The concentrated liquidity and efficient price discovery create near-CEX conditions for large trades.

However, the July 2025 outage exposed critical vulnerabilities. The platform went completely offline for 37 minutes during volatile market conditions, leaving leveraged traders unable to manage positions. Despite showing "100% uptime" on status pages, the incident required $1.99 million in trader reimbursements.

ApeX Protocol's distributed architecture provides different advantages. While individual chains might experience congestion, the multi-chain redundancy means trading continues on unaffected networks. Users can shift collateral between chains as conditions change, accessing the most liquid markets dynamically.

Security Incidents and Response

The March 2025 JellyJelly token exploit on Hyperliquid revealed how custom infrastructure creates novel attack vectors. Attackers manipulated an illiquid token's price by +429% on external exchanges to target the HLP vault. While validators responded within minutes by delisting the token, this emergency intervention contradicted decentralization claims.

North Korean hackers have specifically targeted Hyperliquid, with researchers documenting $458,000+ in testing activities over one week. The platform's high-profile success attracts sophisticated adversaries.

In contrast, ApeX Protocol benefits from battle-tested infrastructure. StarkEx has processed over $1 trillion in cumulative volume across applications, while zkLink's canonical bridge approach avoids custom implementation risks. The Light Oracle Network adds defensive depth against sequencer-oracle collusion.

Strategic Positioning: Different Solutions for Different Traders

Hyperliquid's Performance-First Approach

Hyperliquid targets professional traders and market makers who prioritize:

Maximum execution speed for high-frequency strategies

Deep liquidity in major perpetual contracts

Institutional-grade features like advanced order types

The platform's tokenomics reflect this focus. The massive HYPE airdrop—310 million tokens to 94,000 users—created deep community ownership. With 97% of fees distributed to the community through buybacks and HLP rewards, the model aligns incentives effectively. Five NASDAQ companies now hold HYPE in treasury, signaling institutional confidence.

ApeX Protocol's Accessibility-First Strategy

ApeX Protocol serves traders who value:

Cross-chain flexibility without manual bridging

Mobile-first experience for trading on the go

Social features and gamified rewards for community engagement

The platform's recent 50% token supply reduction (from 1B to 500M APEX) improved tokenomics sustainability. The upcoming 25M APEX airdrop aims to expand ecosystem participation across all supported chains.

Future Roadmaps: Convergence or Divergence?

Hyperliquid's Expansion Plans

The February 2025 HyperEVM launch marks Hyperliquid's evolution beyond pure derivatives trading. With 100+ applications already building, the platform aims to become comprehensive DeFi infrastructure. Key developments include:

Validator decentralization: Gradual expansion from current 16 validators

Native multi-asset support: BTC, ETH, and SOL deposits beyond USDC

Smart contract composability: Enabling complex DeFi strategies on-chain

ApeX Protocol's Innovation Pipeline

ApeX is developing its own ApeX Trading Chain while maintaining multi-chain connectivity. The roadmap emphasizes:

AI Copilot integration: Advanced analytics and trading assistance

Yield-bearing collateral: Productive assets as trading collateral

Pre-market trading: Access to tokens before official launches

Modular feature deployment: Rapid innovation without chain upgrades

Industry Perspective: Room for Both Approaches

VanEck predicts $4 trillion in DEX trading volume by 2025, with DEXs capturing 20% of CEX spot trading. This massive growth supports multiple architectural approaches serving different segments.

Messari's research identifies intent-based systems as optimal for multi-chain DEXs, validating ApeX's strategic direction. Meanwhile, Delphi Digital emphasizes application-specific infrastructure advantages for performance-critical use cases like Hyperliquid.

Academic research from 2024 confirms that custom L1 solutions outperform multi-chain approaches for specific applications while highlighting persistent trade-offs. The consensus: architectural diversity strengthens the ecosystem rather than fragmenting it.

Why ApeX's Multi-Chain Approach Benefits Everyday Traders

While both architectures push DEX innovation forward, ApeX Protocol's multi-chain model specifically addresses common trader pain points:

• Gasless Perpetual Trading: Trade perpetual futures without worrying about network costs, even during peak volatility

• Native Multi-Chain Liquidity: Access unified liquidity from multiple blockchains without manual bridging or network switching

• Alpha Radar Token Discovery: AI-driven tool scans on-chain activity and social sentiment to flag trending tokens early

• Integrated Staking & Vaults: Earn passive yield through automated strategies without leaving the platform

By removing fees, unifying markets, surfacing data insights, and adding earning opportunities, ApeX's approach directly tackles friction points that keep mainstream users from DeFi trading.

Conclusion: Complementary Paths Forward

The own-chain versus multi-chain debate isn't about finding a winner—it's about recognizing how different architectures serve distinct market needs. Hyperliquid's dedicated L1 delivers unmatched performance for professional trading, achieving volumes that dwarf competitors. Its 78.8% market dominance proves the demand for CEX-competitive speeds in DeFi.

Meanwhile, ApeX Protocol's multi-chain architecture solves fundamental accessibility challenges. By abstracting away blockchain complexity and unifying fragmented liquidity, it creates pathways for mainstream adoption that performance-optimized chains cannot match.

The future likely holds both approaches thriving in parallel: own-chain DEXs capturing high-value professional volume while multi-chain platforms drive user growth and ecosystem integration. Success depends not on choosing the "right" architecture, but on executing excellently within chosen design constraints.

As the DEX ecosystem matures, we're witnessing specialization rather than convergence. And that's exactly what a diverse, resilient DeFi ecosystem needs—multiple approaches pushing boundaries in different directions, each contributing essential infrastructure for the decentralized financial future.

Trade Smarter with ApeX Omni Unlock the full potential of decentralized trading on ApeX Omni. From crypto perpetuals and spot markets to U.S. stocks and prediction markets, everything you need is in one place. With deep liquidity, powerful trading tools, and zero gas fees, ApeX Omni makes it easy to build and execute strategies that match your trading style.

Earn While You Learn — $100 USDT Per Quest Your trading knowledge can now pay off. Join our Learn & Earn series on Galxe, where each quick quiz you complete rewards you with $100 USDT.

Simply connect your wallet to ApeX Omni, take the quiz, and claim your reward. Fast, simple, and designed to help you grow while you earn.