What Are Funding Rates and Why They Matter

In crypto derivatives, the funding rate is the periodic fee exchanged between traders holding perpetual futures positions. Unlike spot trading, perps have no expiry, so funding fees incentivize traders to keep contract prices tethered to actual spot prices.

The funding rate is essentially the carry cost of holding a perpetual position. It's a recurring payment exchanged between long and short traders - not a fee paid to the platform. When the rate is positive, long positions pay shorts; when negative, shorts pay longs. This system aligns the perpetual's price with the spot price of the asset.

Think of funding rates as the interest you pay (or earn) for leverage. A high funding rate means it's costly to hold one side of the market, nudging traders to rebalance positions. Ignoring funding can turn a good trade into a losing one, while understanding it lets you manage the "hidden" costs of trading and even spot when the market is overextended.

How Funding Rates Are Determined

Funding rates are typically a function of two components: an interest rate baseline and a premium/discount index. Exchanges set a small fixed interest (usually ~0.01% per 8 hours) and add a premium index based on the perp's price deviation from spot. If the perp trades above the index, the premium is positive; if below, it's negative.

Most major exchanges update funding every 8 hours by default, though some use hourly funding. You only pay or receive funding if you hold a position at the moment of the funding snapshot.

How Funding Keeps Perps Near Spot

Funding rates act as an economic lever pulling perpetual prices back toward the spot market. When the perpetual's price strays from spot, funding payments encourage traders to do the opposite of what's causing the divergence.

For example, if Bitcoin's perp trades above spot (aggressive long demand), the funding rate turns positive. Longs must pay shorts a fee at regular intervals, making long positions less attractive over time. Rational traders respond by closing longs or opening shorts to receive funding, creating sell pressure that nudges the perp price down toward spot.

The opposite works when the perp is below spot: funding becomes negative, shorts pay longs, motivating some shorts to cover and traders to go long. This mechanism is crucial because unlike quarterly futures, perps don't have an expiry to naturally meet the spot price - funding is the only thing anchoring them to their underlying.

Reading Funding Like a Trader

Funding rates broadcast valuable information about market sentiment:

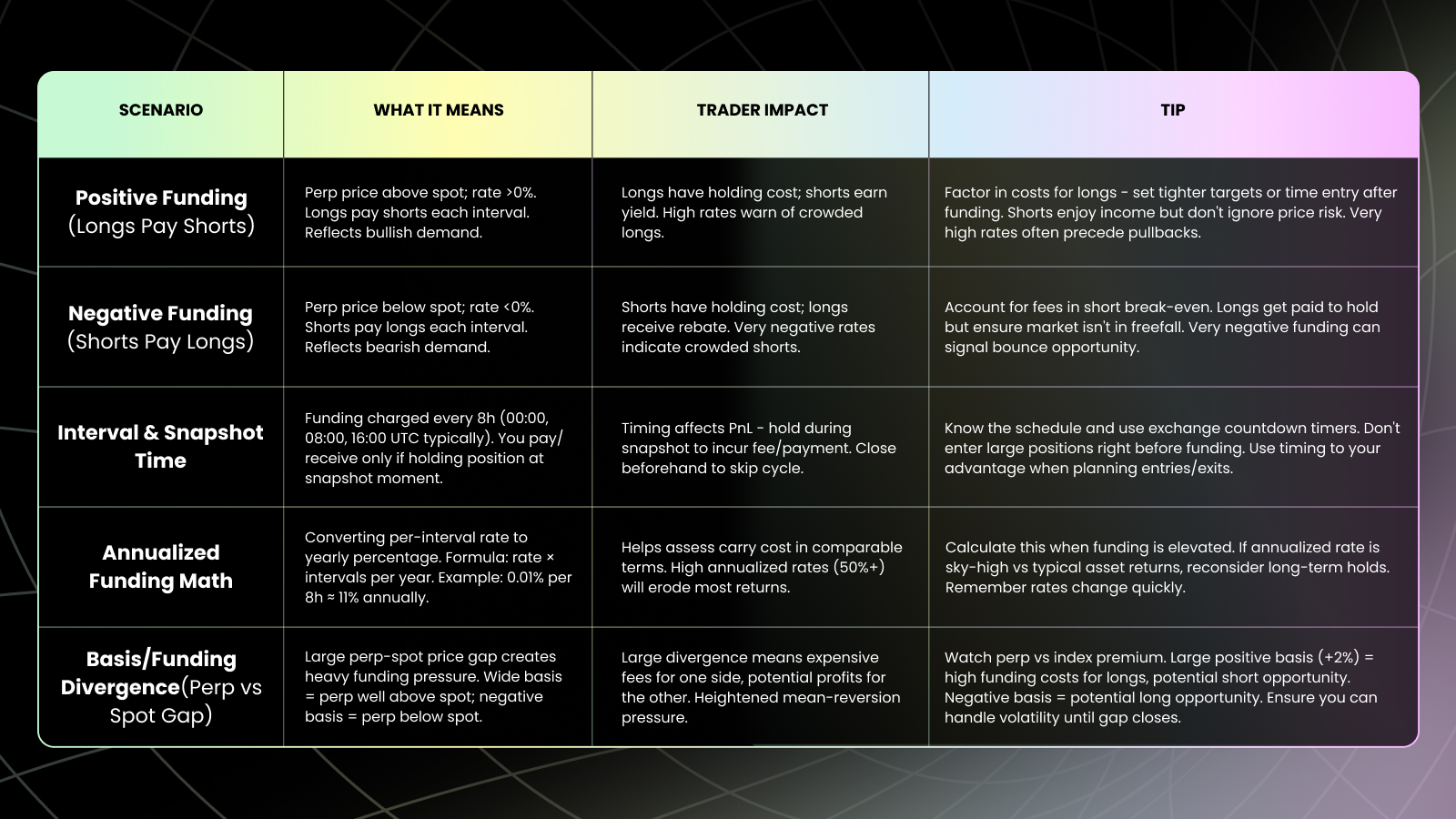

Positive Funding (Longs Pay Shorts)

This signals bullish bias - traders are willing to pay a premium to stay long. Moderately positive funding (0.01%-0.03% per interval) is common in uptrending markets. However, very high positive funding often warns of crowded, over-leveraged longs. Historically, consistently high funding rates have preceded market pullbacks.

When funding climbs to extreme levels (>0.1% for 8h intervals), it signals the long side is stretched. Savvy traders may scale back longs or consider contrarian shorts when funding is uncharacteristically high.

Negative Funding (Shorts Pay Longs)

This signals bearish sentiment - shorts are dominant and willing to pay to stay short. Deep negative rates can indicate panic or overshooting to the downside. During episodes like major market crashes, funding goes deeply negative as shorts pile in, often marking capitulation bottoms followed by sharp rebounds.

Extremely negative funding suggests short squeeze opportunity. Traders seeing heavily negative funding might prepare to go long to ride an oversold bounce - you're literally being paid to buy when fear is high.

Neutral or Low Funding

Near-zero funding suggests a balanced market with perpetuals trading right at spot. This often coincides with ranging markets driven by genuine spot trading rather than heavy leverage.

Annualizing the Rate

To grasp magnitude, traders often annualize funding rates. A 0.01% funding every 8 hours equates to about 11% per year in carry cost. A rate of 0.10% per 8h would be over 100% yearly - extremely costly to sustain. If you see a rate implying triple-digit yearly cost, it's a red flag that one side is crowded.

Funding and Your PnL: Concrete Examples

Example A - Long with Positive Funding

You're long a $50,000 BTC perpetual position. Funding rate is +0.02% per 8-hour interval:

Funding cost: 0.02% of $50,000 = $10 every 8 hours ($30 per day)

Weekly cost: About $210 over one week

Break-even requirement: BTC needs to rise at least 0.42% over the week just to offset funding fees

Example B - Short with Funding Benefit

Short $50,000 notional with +0.02% funding:

Funding income: You earn $10 every 8 hours as shorts receive payments from longs

Price cushion: If BTC rises 0.5% ($250 loss), you collected $30 in funding that day, netting $220 loss instead

Break-even analysis: Over a week, you collect $210, so the asset could rise 0.42% and you'd still break even

Timing, Intervals, and Snapshots

Funding intervals are typically every 8 hours at 00:00 UTC, 08:00 UTC, and 16:00 UTC. You pay or receive funding only if holding a position at the exact snapshot time.

Key Timing Considerations:

Close your position even a minute before funding timestamp to avoid that period's payment

Around funding moments, expect potential volatility as traders adjust positions

Convert UTC times to your local timezone and use exchange countdown timers

During high volatility events coinciding with funding, consider flattening positions temporarily

Strategies Impacted by Funding

Momentum & Swing Trading

In strong uptrends, funding rates tend to run positive, creating drag on long positions. Short-term swings might see negligible cost, but multi-day holds accumulate fees. Consider entering longs right after funding payments and tightening stops when funding soars.

Cash-and-Carry (Hedged Spot + Short Perp)

Buy the asset on spot and short equivalent perpetual amount. If perp trades above spot, funding will be positive, meaning your short receives payments regularly while price risk is hedged. This market-neutral strategy can be very lucrative during bull markets when funding yields are high.

Reverse Carry (Short Spot + Long Perp)

Used when perps trade at discount (negative funding). Short spot asset and go long perp to receive funding payments while hedging price risk. Less common but profitable during extreme bearish sentiment.

Market-Neutral Basis Trades

Monitor funding across multiple platforms. Go short on high-funding venues and long on low-funding venues to capture spread while maintaining market neutrality.

Risk Controls and Practical Tips

Position Sizing for High Funding

Scale down position size when funding is unusually high against you. High funding means high carrying cost - smaller positions reduce absolute fees and buy time for trades to work out.

Collateral Choice

Stablecoin margin: Margin value stays steady regardless of crypto price swings

Coin margin: Fluctuates with market - can amplify outcomes both ways

Isolated vs. Cross Margin

Isolated: Confines risk to allocated margin for that position - useful for high-funding trades

Cross: Uses whole account equity - good for correlated positions where you want offset

Monitoring and Alerts

Set alerts for funding rate changes above thresholds (e.g., >0.05% or turning negative). Watch funding trends as closely as price action. Monitor countdown clocks and reassess positions 15-30 minutes before settlements.

Avoiding the "Funding Squeeze"

Don't get stuck in positions purely for funding income. If market moves against you, don't double down just to collect more funding - that's like picking up pennies in front of a steamroller.

Pre-Trade & In-Trade Checklists

Before Entering:

Check current funding rate and recent trend: Look at whether the rate is at extremes or steadily climbing in your trade's direction, which warns of crowded positioning. Use sites like Coinglass to compare funding across assets and spot market-wide leverage extremes.

Note next funding timestamp and plan entry timing: Know when the next settlement occurs (typically 00:00, 08:00, 16:00 UTC) to avoid paying immediate fees or ensure you collect payments. Account for potential volatility around these times as traders adjust positions.

Calculate projected carry cost/income over expected holding period: Estimate total funding impact over your planned hold time (e.g., $100k position at 0.01% for 3 days = $90 cost). Factor this into your profit target to ensure the trade's reward justifies the carrying cost.

Factor both trading fees and funding into break-even analysis: Add entry/exit fees plus projected funding to determine your true break-even price. Write this down to prevent chasing marginal trades that can't overcome fee drag.

Set appropriate margin mode and buffer: Choose isolated margin for high-risk trades or cross margin for correlated positions. Deposit 50-100% more margin than the minimum required to handle funding costs and price volatility safely.

Define stop-loss incorporating funding considerations: Set rules like "exit if funding flips against me" or "close before next funding if trade hasn't moved." Remember, funding payments effectively raise your break-even price over time if paying fees.

While In Trade:

Monitor funding rate changes and flips: Watch for direction changes that signal major sentiment shifts or price crossing the index. Funding spikes may indicate overcrowded trades requiring tighter risk management.

Decide whether to hold through upcoming funding timestamps: Cut losing positions before paying more fees, or hold profitable ones to collect large payments then reassess. Some traders temporarily reduce size before funding to minimize costs.

Avoid being greedy with funding income at the expense of price risk: Don't let funding payments cloud judgment about price action - the market can quickly take back what it gives in funding. Use income as a buffer, not an excuse to ignore stops.

Track cumulative funding vs. price PnL: Separate total PnL into price movement versus funding to understand if gains come from directional skill or just carry income. This reveals whether your trade thesis is actually working.

Stay agile as market conditions change: Be ready to exit when funding conditions that supported your trade thesis change dramatically due to news or sentiment shifts. Don't stick to original plans when the environment has shifted.

Funding at a Glance

FAQ

Q: Do I pay funding if I close before the timestamp?

A: No - funding is only charged to positions held at the exact settlement time.

Q: Why is funding often positive in crypto?

A: Crypto markets have historically had bullish bias with traders willing to pay premiums to go long. This reflects optimistic sentiment and growth expectations.

Q: How do I calculate annualized funding?

A: Multiply per-period rate by periods per year. For 8-hour funding: rate × 3 × 365. Example: 0.01% per 8h ≈ 10.95% annually.

Q: Can negative funding make hedges profitable?

A: Yes. If you're long perps with negative funding while short equivalent spot/futures, you collect funding income while hedging price risk - essentially a reverse cash-and-carry trade.

Q: How do fees plus funding affect break-even?

A: They raise the price threshold needed for profit. Always calculate total costs (entry/exit fees + expected funding) and ensure your price target exceeds this hurdle.

Conclusion: Trade the Market, Not Just the Rate

Funding rates are vital to perpetual trading - they anchor prices, signal sentiment, and create costs/opportunities spot traders never face. The key is integration: weave funding awareness into every trading decision while remembering it's secondary to actual market movement.

Don't become so fixated on avoiding fees or earning funding that you miss the bigger picture. It's better to pay modest funding on a hugely profitable trade than miss the trade entirely. Use funding as a tool to refine entries, exits, and holding decisions, but base core strategy on sound price action, volume, and fundamental analysis.

When used wisely, funding rates sharpen your edge by warning of crowded trades, providing extra income on good positions, and helping time moves with precision. Approach each trade holistically: plan for price path, account for funding impact, and set risk limits accordingly.

Trade Smarter with ApeX Omni

Unlock the full potential of decentralized trading on ApeX Omni. From crypto perpetuals and spot markets to U.S. stocks and prediction markets, everything you need is in one place. With deep liquidity, powerful trading tools, and zero gas fees, ApeX Omni makes it easy to build and execute strategies that match your trading style.

Earn While You Learn — $100 USDT Per Quest

Your trading knowledge can now pay off. Join our Learn & Earn series on Galxe, where each quick quiz you complete rewards you with $100 USDT. Simply connect your wallet to ApeX Omni, take the quiz, and claim your reward.