Introduction: Why This Comparison Still Matters

Cryptocurrency markets offer various ways to trade, and understanding perpetual vs spot trading is crucial for anyone moving beyond basic buy-and-sell. Spot trading—buying or selling actual crypto for immediate delivery—is straightforward, but perpetual trading basics can seem complex at first. Perpetual futures (“perps”) have exploded in popularity because they let traders use leverage and profit in both rising and falling markets.

This article demystifies perps for spot-savvy readers. You’ll learn what they are, how funding, margin and liquidation work, why they can be attractive (capital efficiency, two-way opportunities, hedging), and where the risks lie—so you can choose the right instrument for the job.

What Is Spot Trading?

Spot trading is the direct purchase or sale of a cryptocurrency at the current market price for immediate settlement. In a spot trade, assets change hands—you pay in full, and you own the coin or token outright.

Key Characteristics

Immediate settlement: Trade is completed “on the spot.”

Actual ownership: You can withdraw and use the asset in DeFi, payments, staking, and more.

No embedded leverage: Unless you separately borrow, you trade with fully paid funds.

Simple pricing: What you see is the market price; no funding mechanics.

Benefits

Simplicity: Easy to understand; minimal moving parts.

No liquidation risk: Holdings can drop in value, but they won’t be force-closed.

No ongoing carry cost: No funding fees for holding spot.

Utility: You can use the underlying asset.

Drawbacks

Full capital outlay: Requires 100% of the trade value upfront.

One-directional by default: Profits mainly come from price increases.

No built-in leverage: Gains scale 1:1 with price moves.

Opportunity cost: Capital tied up in holdings.

What Is a Perpetual Futures Contract?

A perpetual futures contract is a derivative that tracks an asset’s price without transferring ownership of the underlying. Perps have no expiry, so you can hold positions indefinitely—provided you meet margin requirements and funding payments.

The contract stays near spot via the funding rate: a periodic fee exchange between longs and shorts. If the perp trades above spot, longs pay shorts (positive funding); if below, shorts pay longs (negative funding). Funding is typically charged multiple times per day and varies with market conditions.

Perps are traded on margin with leverage. You post collateral (often USDT or another stablecoin) to control a larger notional position. Because you’re leveraged, adverse moves can trigger liquidation when losses overwhelm the collateral buffer; the exchange closes your position to prevent losses beyond your deposit.

Key Characteristics

No expiry: Hold positions as long as you maintain margin and manage funding.

Synthetic exposure: You gain price exposure without owning the asset.

Margin & leverage: Control larger notional with smaller collateral.

Funding rate: Periodic payments keep perp prices near spot.

Mark price & liquidation: Liquidation is based on a fair-value mark, not just the last trade.

Collateral type: USD pegged stablecoin/stable-margined perps settle P&L in stablecoins; coin-margined perps settle in the crypto itself.

Benefits

Long or short with ease: Profit in both market directions without borrowing assets.

Capital efficiency: Leverage amplifies exposure. Example: With $1,000 collateral at 5×, you control $5,000 notional. A +2% move yields about +$100 (10% on collateral). A –2% move costs $100 (–10% on collateral).

No rollovers: Unlike dated futures, perps don’t expire.

Hedging: Efficiently offset risk on spot holdings (e.g., short BTC-PERP against spot BTC).

Risks & Considerations

Leverage cuts both ways: Losses are magnified just like gains; avoid over-leverage.

Liquidation risk: If equity falls below maintenance margin, positions are force-closed.

Funding costs: Holding a position long-term can be costly if funding runs against you.

Margin modes matter:

Isolated: Risk confined to one position (tighter liquidation buffer).

Cross: Shared collateral across positions (more buffer, but more account-wide risk).

Platform safeguards: Insurance funds and, in extreme events, auto-deleveraging exist—but disciplined risk management is still essential.

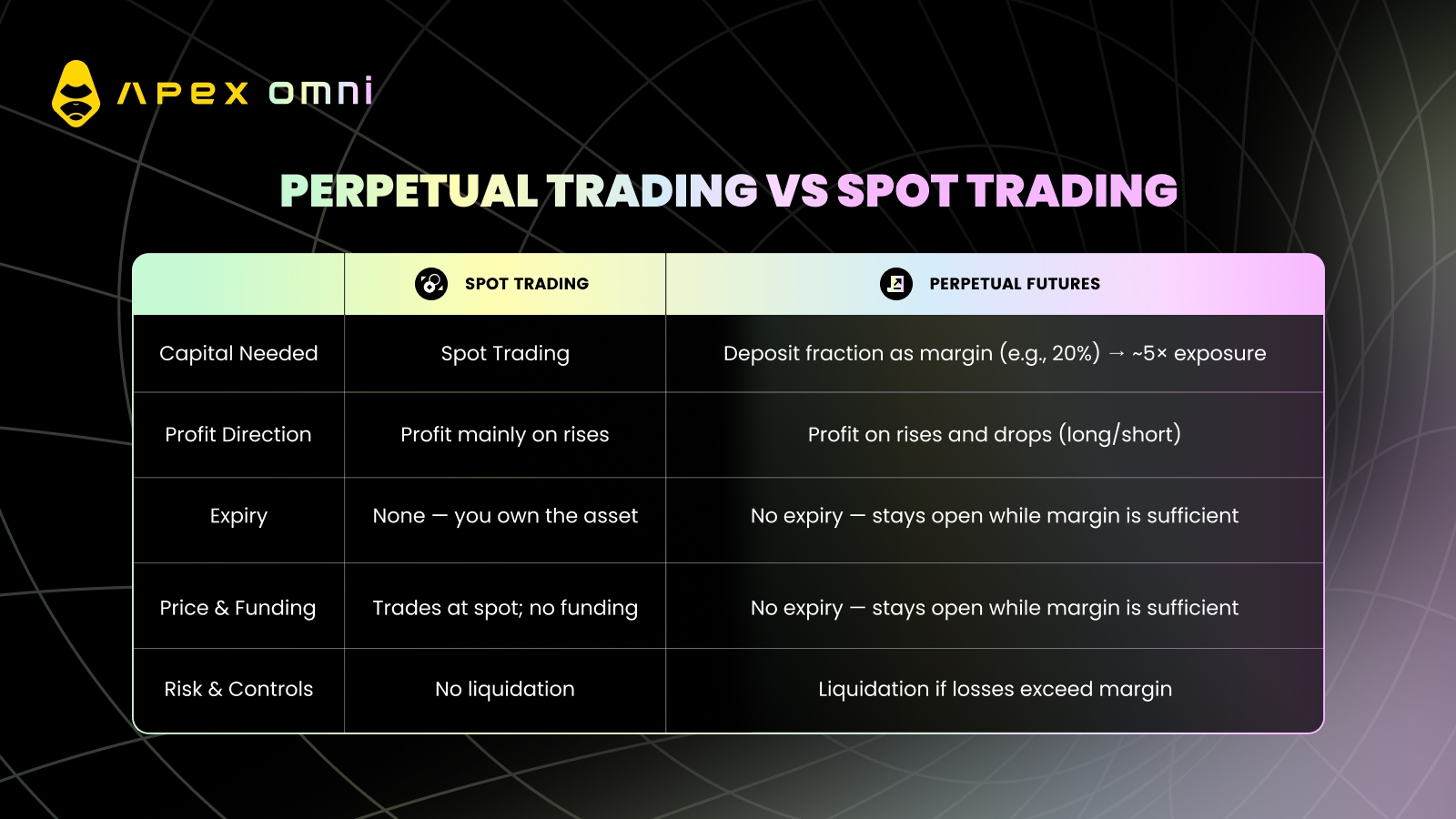

Perpetual vs Spot: A Direct Comparison

Use Cases: When to Choose Spot vs Perps

Accumulation / Treasury (Spot): Build long-term holdings, avoid liquidation and funding costs, preserve asset utility (staking, governance).

Hedging Existing Holdings (Perps): Short a perp to offset risk on a spot portfolio without selling core assets.

Short-Term Speculation (Perps): Use moderate leverage and tight stops to express directional views over hours to days.

Market-Neutral / Delta-Neutral (Spot + Perps): Pair spot and perps (e.g., cash-and-carry, funding capture) to target carry or basis with limited directional exposure.

FAQ

Are perps only for high-risk traders? No. They enable high risk, but you can use moderate leverage, strict stops, and isolated margin to keep risk contained.

How do funding fees affect my P&L? Funding is a periodic credit/debit. If you’re on the paying side, it reduces returns over time; if you’re on the receiving side, it boosts them. For long holds, funding can be a significant cost.

Can I hedge my spot BTC with a perp? Yes. Short BTC-PERP in a size that matches your spot exposure to offset downside, then close the hedge when conditions improve.

What moves my liquidation price? Leverage, collateral, position size, and mode (cross vs isolated). Adding margin or reducing size moves liquidation farther away; removing margin or increasing leverage brings it closer.

Do perps have expiry? No. They’re perpetual. You can hold indefinitely if you manage margin and funding.

Conclusion: Choosing the Right Instrument

Spot trading is simple, ownership-based, and free from liquidation risk—ideal for long-term holders and anyone who wants utility from the asset. Perps add powerful tools: leverage, easy shorting, and efficient hedging. They also add complexity—funding, margin, and liquidation—so discipline is non-negotiable.

A practical approach is to mix both: hold a core spot portfolio, and use perps selectively for hedges or short-term opportunities. Keep leverage modest, respect your liquidation buffer, and account for funding. Used thoughtfully, perps can complement a spot strategy and expand what’s possible in your playbook.

Trade Smarter with ApeX Omni

Unlock the full potential of decentralized trading on ApeX Omni. From crypto perpetuals and spot markets to U.S. stocks and prediction markets, everything you need is in one place. With deep liquidity, powerful trading tools, and zero gas fees, ApeX Omni makes it easy to build and execute strategies that match your trading style.

Earn While You Learn — $100 USDT Per Quest

Your trading knowledge can now pay off. Join our Learn & Earn series on Galxe, where each quick quiz you complete rewards you with $100 USDT.

Simply connect your wallet to ApeX Omni, take the quiz, and claim your reward. Fast, simple, and designed to help you grow while you earn.