![]() High-Performance Trading

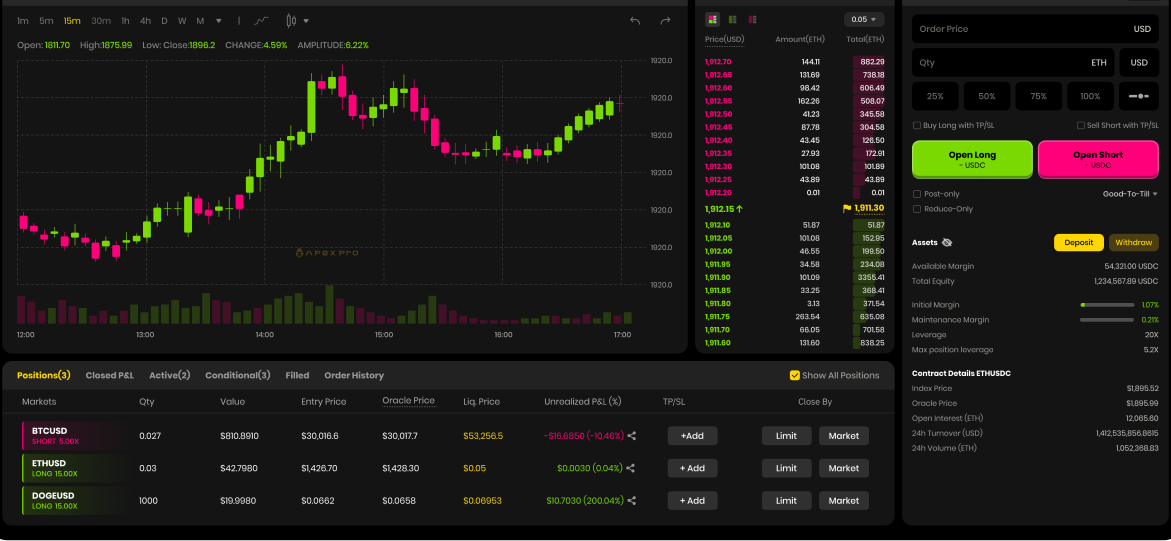

High-Performance Trading

Benefit from rapid order execution of up to 10,000 transactions per second (tps) and advanced order types for a seamless trading experience.

![]() High-Performance Trading

High-Performance Trading

Benefit from rapid order execution of up to 10,000 transactions per second (tps) and advanced order types for a seamless trading experience.

![]() Low Fees, Zero Gas Fees

Low Fees, Zero Gas Fees

Benefit from taker fees as low as 0.05%, maker fees of 0.02%, and zero gas fees, reducing your trading costs.

![]() Deep Liquidity & High Leverage

Deep Liquidity & High Leverage

Trade with deep liquidity and leverage up to 100x, giving you flexibility and increased potential for returns.

![]() Grid Bot with Negative Fees

Grid Bot with Negative Fees

Automate your trades with our grid bot and enjoy a negative maker fee of -0.002%, maximizing your profitability.

![]() Cross Margin Trading

Cross Margin Trading

Use USDC (and soon other assets like USDe, FBTC, WBTC, ETH, WETH) to back your positions and enjoy greater flexibility in managing margin.

![]() Decentralization & Self-Custody

Decentralization & Self-Custody

Retain full control over your assets with decentralized, self-custodial trading. Powered by zkLink, enjoy enhanced security and trustless transactions.

![]() 70+ Perpetual Markets Available

70+ Perpetual Markets Available

Stay ahead with quick listings of trending pairs—more than 70 pairs are available right now and more are being added regularly.

![]() Seamless Access on Web & App

Seamless Access on Web & App

Enjoy a seamless trading experience with an intuitive UI/UX, available on both web and mobile apps.

BTC

1.76%

$583.36M

ETH

1.05%

$75.62M

APEX

7.35%

$15.24M

LIT

6.74%

$35.44K